Introduction of Annual Recurring Revenue (ARR) Calculator

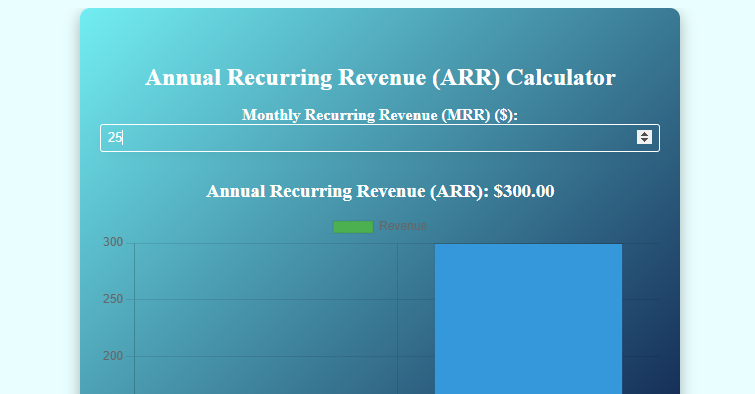

Annual Recurring Revenue (ARR) Calculator

Annual Recurring Revenue (ARR): $0.00

Annual Recurring Revenue (ARR) is a crucial financial metric for businesses operating on a subscription model. Understanding ARR helps companies measure predictable revenue, track growth, and make informed financial decisions. An ARR calculator simplifies the process by providing accurate calculations based on key revenue components.

In this guide, we’ll explore the importance of ARR, how to calculate it, the benefits of using an ARR calculator, and effective strategies for increasing ARR for sustainable business growth.

What is Annual Recurring Revenue (ARR)?

SaaS companies, membership-based businesses, and other subscription-driven models commonly use free Annual Recurring Revenue calculators to measure their long-term financial health. It represents the total predictable revenue a company expects from subscriptions or long-term contracts over a year. It excludes one-time fees, variable costs, and non-recurring revenue.

Importance of ARR

- Predictable Revenue: Helps businesses forecast future earnings and budget effectively.

- Investor Insights: Investors use ARR to evaluate a company’s financial health and growth potential.

- Growth Tracking: Businesses can assess performance and adjust strategies accordingly to enhance profitability.

- Subscription Model Optimization: Identifies trends in customer retention and churn rates, helping refine pricing models and service offerings.

ARR vs. MRR

Another related metric is Monthly Recurring Revenue (MRR), which calculates revenue on a month-to-month basis. ARR is simply an annualized version of MRR: ARR = MRR × 12

How to Calculate ARR

ARR Formula:

ARR = (Total Subscription Revenue + Expansion Revenue) – Churn Revenue

Breakdown of ARR Components:

- Total Subscription Revenue: Revenue generated from recurring subscriptions.

- Expansion Revenue: Additional revenue from existing customers (upgrades, add-ons, cross-sells).

- Churn Revenue: Lost revenue due to customer cancellations or downgrades.

Example Calculation

Assume your business has:

- $500,000 in subscription revenue

- $50,000 in expansion revenue

- $30,000 in churn revenue

Using the formula: ARR = ($500,000 + $50,000) – $30,000 = $520,000

This metric allows businesses to monitor financial trends, adjust their pricing models, and forecast revenue growth effectively.

ARR Calculator: Simplifying Revenue Tracking

Why Use an ARR Calculator?

Calculating ARR manually can be time-consuming and prone to errors. An Annual Recurring Revenue calculator automates the process, ensuring accuracy and efficiency while saving time.

Features of an ARR Calculator:

- Automated Calculations: Eliminates human errors and ensures quick, reliable results.

- Custom Inputs: Allows businesses to input specific revenue details based on subscription plans.

- Visual Insights: Generates reports, graphs, and trend analyses for data-driven decision-making.

- Scenario Analysis: Helps predict revenue changes based on customer retention, pricing adjustments, and new product launches.

- Integration with Other Tools: Many ARR calculators can integrate with CRM and accounting software, making revenue tracking seamless.

How to Increase Your ARR

A high ARR reflects strong business health and growth potential. Here are some effective strategies to boost ARR:

1. Reduce Churn Rate

Customer churn is one of the biggest obstacles to maintaining a healthy ARR. Strategies to reduce churn include:

- Providing exceptional customer support to enhance user satisfaction.

- Implementing loyalty programs to reward long-term customers.

- Offering personalized offers, discounts, and incentives to retain customers.

- Regularly collecting feedback to improve the product or service.

2. Upsell & Cross-Sell

Expanding revenue from existing customers is a powerful way to increase ARR. Strategies include:

- Introducing higher-tier subscription plans with additional features.

- Promoting premium add-ons and services to current subscribers.

- Offering bundle packages that encourage customers to spend more.

3. Improve Customer Acquisition

Attracting new customers is essential for ARR growth. Effective methods include:

- Optimizing marketing strategies through SEO, PPC, and content marketing.

- Leveraging social proof, testimonials, and case studies to build credibility.

- Running targeted campaigns that highlight the value of subscription plans.

4. Enhance Product Value

Customers are more likely to stick with a service that continuously improves. Ways to enhance product value include:

- Regularly introducing new features based on customer feedback.

- Offering educational content and onboarding programs to improve user experience.

- Providing seamless integration with third-party tools and services.

5. Optimize Pricing Strategies

Pricing can significantly impact ARR. Consider:

- A/B testing different pricing models to find the most effective approach.

- Offering annual payment plans with discounts to encourage long-term commitments.

- Introducing flexible payment structures to cater to a broader customer base.

Common Challenges in ARR Calculation

While ARR is a valuable metric, businesses may encounter challenges, such as:

- Inconsistent Revenue Streams: Companies with variable subscription terms must standardize their calculations.

- High Customer Churn: Losing too many customers offsets new revenue gains.

- Over-Reliance on One-Time Fees: Relying on non-recurring revenue can mislead ARR assessments.

By addressing these challenges proactively, businesses can ensure a more accurate representation of their financial health.

Conclusion

Annual Recurring Revenue (ARR) is an essential metric for subscription-based businesses to track growth, measure financial stability, and plan for the future. Using an ARR calculator simplifies the process, allowing companies to focus on optimizing revenue strategies.

By reducing churn, expanding existing customer relationships, enhancing product offerings, and improving marketing efforts, businesses can maximize ARR and achieve long-term success. Whether you are a startup or an established company, tracking ARR effectively through an ARR calculator can provide valuable insights to help you scale and drive profitability.

Start using a Free ARR calculator 👇 on Shark Tank today to streamline your financial tracking and take your business growth to the next level!