What is EBITDA?

EBITDA calculator (Earnings Before Interest, Taxes, Depreciation, and Amortization) is a crucial financial metric that helps businesses and investors assess a company’s profitability and operational efficiency. Unlike net income, EBITDA focuses purely on earnings generated from core business activities, excluding non-operational expenses and accounting adjustments. It is widely used in financial analysis, investment decisions, and business valuations.

Why is EBITDA Important?

EBITDA serves as an essential tool for:

- Assessing Operational Performance: By eliminating external financial factors, EBITDA provides a clearer picture of a company’s profitability.

- Comparing Companies: Investors and analysts use EBITDA to compare companies across different industries without being influenced by tax policies or depreciation schedules.

- Business Valuation: Many valuation models, including those used in mergers and acquisitions, rely on EBITDA to estimate a company’s value.

EBITDA Formula

EBITDA can be calculated using two primary formulas:

- Direct Calculation from Financial Statements: EBITDA=NetIncome+Interest+Taxes+Depreciation+AmortizationEBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

- Operating Profit-Based Formula: EBITDA=OperatingProfit+Depreciation+AmortizationEBITDA = Operating Profit + Depreciation + Amortization

Both approaches yield the same result but vary depending on the data available.

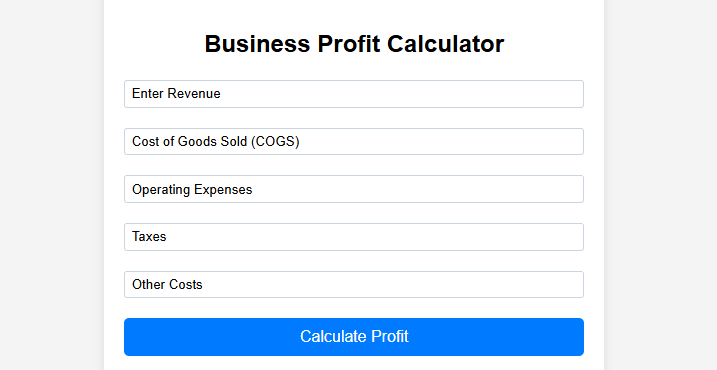

How to Use the EBITDA Calculator

Our EBITDA Calculator simplifies the process by automatically computing EBITDA based on the provided financial details. Here’s how you can use it:

- Input Financial Data: Enter your net income, interest expense, tax expense, depreciation, and amortization.

- Click Calculate: The calculator instantly processes the input and provides the EBITDA value.

- Analyze the Results: Use the output to assess profitability, compare with industry benchmarks, or determine business valuation.

- Reset for New Calculations: Modify input values to explore different scenarios.

Example Calculation

Let’s assume a business has the following financials:

- Net Income: $500,000

- Interest Expense: $50,000

- Taxes: $100,000

- Depreciation: $80,000

- Amortization: $20,000

Using the formula: EBITDA=500,000+50,000+100,000+80,000+20,000=750,000EBITDA = 500,000 + 50,000 + 100,000 + 80,000 + 20,000 = 750,000

The EBITDA of this company is $750,000, providing a clearer insight into its operating performance.

Key Benefits of Using an EBITDA Calculator

- Saves Time: No manual calculations needed.

- Improves Accuracy: Reduces the risk of errors in financial analysis.

- Helps Decision-Making: Provides quick insights into business profitability.

- Enhances Comparability: Enables easier comparison with competitors.

Limitations of EBITDA

While EBITDA is a valuable tool, it does have limitations:

- It does not consider capital expenditures, which are crucial for asset-heavy businesses.

- It ignores changes in working capital.

- It may overstate profitability for businesses with high debt levels.

Conclusion

The free EBITDA Calculator is an essential financial tool for business owners, investors, and analysts. By focusing on earnings from core operations, it offers a transparent measure of profitability, eliminating the effects of financing decisions, tax policies, and accounting methodologies. This makes it an invaluable metric for comparing businesses across industries and understanding their true financial performance.

Whether you’re evaluating a potential investment, planning business growth, or preparing for an acquisition, this tool provides clarity on a company’s ability to generate profits. Investors rely on EBITDA to assess a company’s operational efficiency, while business owners use it to streamline financial planning and strategy. Additionally, lenders and financial institutions often consider EBITDA when assessing creditworthiness and loan applications.

Our free EBITDA Calculator simplifies complex financial analysis, allowing you to make informed, data-driven financial decisions. Try it free 👇 on Sharks Tank Pakistan today to gain deeper insights into your company’s financial health, optimize profitability, and enhance business valuation!

EBITDA Calculator

EBITDA: $0.00

Frequently Asked Questions (FAQs)

1. What is EBITDA, and why is it important?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a financial metric that measures a company’s operating performance by excluding non-operating expenses. It is widely used to compare profitability across companies and industries.

2. How do I calculate EBITDA?

The basic formula for EBITDA is:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

3. What is the difference between EBITDA and net income?

Net income includes all expenses, including taxes, interest, and depreciation, whereas EBITDA focuses only on core operational earnings. This makes EBITDA a clearer representation of operational performance.

4. Can EBITDA be negative?

Yes, EBITDA can be negative if a company’s core operations are not generating sufficient revenue to cover expenses. This could indicate financial distress or operational inefficiencies.

5. Is EBITDA the same as cash flow?

No, EBITDA is not the same as cash flow. While EBITDA measures profitability before non-cash expenses, cash flow accounts for actual cash inflows and outflows, including capital expenditures and changes in working capital.

6. Why do investors and analysts prefer EBITDA?

EBITDA eliminates financial distortions caused by interest, taxes, and accounting practices, making it easier to compare companies across different industries.

7. How can I improve my company’s EBITDA?

Businesses can improve EBITDA by increasing revenue, reducing operational costs, optimizing pricing strategies, and improving overall efficiency.

8. Can EBITDA be used for valuation purposes?

Yes, EBITDA is a key metric used in business valuation. Many analysts use EBITDA multiples to estimate a company’s worth during acquisitions and mergers.

Leverage the power of EBITDA today with our easy-to-use calculator and make more strategic financial decisions!