Understanding your net worth is crucial for making informed financial decisions. A free Net Worth Calculator helps individuals and businesses measure their overall financial health by subtracting liabilities from assets. This figure provides insight into wealth accumulation, debt management, and future financial planning.

In this guide, we’ll cover:

- What net worth is and why it matters

- How to calculate net worth manually

- The benefits of using a Net worth calculator by age

- Real-world applications and strategies for growing net worth

- Common mistakes people make when assessing their net worth

- FAQs about net worth analysis

By the end, you’ll have a clear understanding of how to track, analyze, and improve your financial standing using a Net Worth growth calculator.

What Is Net Worth?

Net worth is a financial metric that represents the difference between what you own (assets) and what you owe (liabilities). A positive net worth indicates financial stability, while a negative net worth signals debt issues that require attention.

Why Is Net Worth Important?

Your net worth is a direct reflection of your financial health. Tracking it regularly can help you:

- Monitor financial progress: See whether your wealth is increasing over time.

- Set financial goals: Plan for retirement, investments, and major purchases.

- Improve budgeting and savings: Identify areas for cost-cutting and better money management.

- Reduce debt: Understand the impact of liabilities on your financial future.

- Enhance creditworthiness: A strong net worth can boost borrowing power for loans and mortgages.

How to Calculate Net Worth

To calculate your net worth, use the following formula:

Step 1: List Your Assets

Assets include anything of value that you own. Categorize them as follows:

- Liquid Assets: Cash, savings, checking accounts, money market funds

- Investments: Stocks, bonds, mutual funds, retirement accounts (401k, IRA)

- Real Estate: Market value of owned property, rental properties

- Personal Property: Vehicles, jewelry, valuable collectibles

- Business Interests: Equity in businesses or startups

Step 2: List Your Liabilities

Liabilities are debts and financial obligations. Common liabilities include:

- Mortgage Loans: Outstanding balance on your home loan

- Auto Loans: Amount owed on financed vehicles

- Student Loans: Educational debt

- Credit Card Debt: Unpaid balances and interest

- Personal Loans: Borrowed funds from banks or private lenders

Step 3: Subtract Liabilities from Assets

For example, if your total assets are $500,000 and your liabilities amount to $200,000, your net worth is:

A positive net worth means you own more than you owe, while a negative net worth indicates that debts exceed assets.

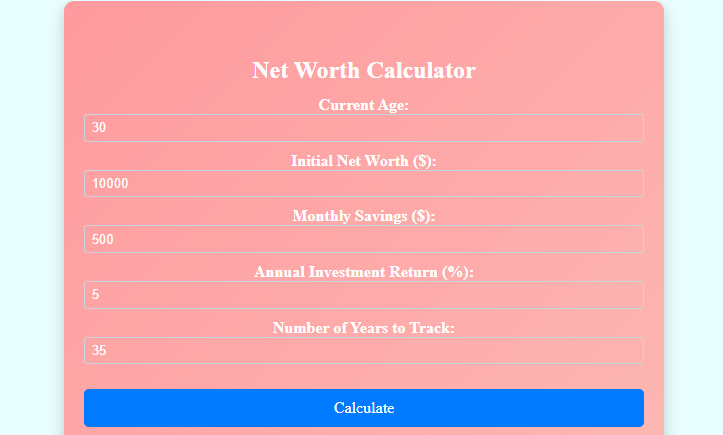

How to Use a Net Worth Calculator

A determine Net Worth Calculator simplifies this process by automatically computing your financial standing.

Steps to Use the Calculator

- Enter Your Assets – Input details of all valuable possessions.

- Enter Your Liabilities – Add all outstanding debts and financial obligations.

- Click Calculate – The tool will instantly determine your net worth.

Benefits of Using a Net Worth Calculator

- Saves time: No manual calculations needed.

- Accurate results: Eliminates errors in computation.

- Customizable inputs: Adjust values based on real-time financial changes.

- Graphical insights: Some calculators provide visual trends in net worth over time.

How to Improve Your Net Worth

Building a healthy net worth requires strategic financial planning. Here are key steps to increase your net worth:

1. Increase Your Assets

- Invest in stocks, real estate, and retirement accounts to grow wealth.

- Start a side business or freelancing to generate additional income.

- Save regularly and capitalize on compound interest through high-yield savings accounts.

2. Reduce Your Liabilities

- Pay off high-interest debt first (credit cards, personal loans).

- Refinance loans for lower interest rates.

- Avoid taking on unnecessary debt (luxury purchases, car loans beyond your means).

3. Optimize Your Spending

- Stick to a budget and track expenses.

- Cut back on non-essential spending (subscriptions, dining out, impulse purchases).

- Use automated savings plans to ensure consistent financial growth.

4. Increase Your Income

- Negotiate a salary raise or switch to a higher-paying job.

- Develop passive income streams (rental properties, dividend investments).

- Upskill through certifications and training for better career opportunities.

Conclusion

A liquid Net Worth Calculator percentile is an essential tool for tracking financial health. Whether you’re planning for retirement, purchasing a home, or managing debt, knowing your net worth helps you make smarter financial decisions.

💡 Want to assess your financial stability? Try our free Net Worth Calculator today at Sharks Tank Pakistan! 🚀

Net Worth Calculator

Results

Estimated Net Worth: $0

By consistently tracking net worth and implementing smart financial strategies, you can build long-term wealth and achieve financial freedom.