Planning for retirement is one of the most important financial decisions you’ll ever make. A Retirement Planning Calculator helps estimate how much you need to save for a comfortable retirement by factoring in your income, savings, expenses, inflation, and expected returns.

This guide will cover:

- What a Retirement Planning Calculator is

- Why retirement planning is essential

- How to calculate your retirement savings goal

- Factors influencing retirement savings

- Common mistakes in retirement planning

- How to use a Retirement Planning Calculator effectively

By the end, you’ll have a clear strategy for achieving financial security in retirement.

What Is a Retirement Planning Calculator?

A Retirement Planning Calculator is a financial tool designed to help you determine:

- How much money you need to retire

- How much you should save each month

- How long your savings will last

- The impact of inflation and investment returns on retirement savings

Why Retirement Planning Is Important

Without proper retirement planning, you risk running out of money in your later years. A Retirement Planning Calculator ensures you:

- Build a sufficient retirement fund

- Understand how different investment strategies impact savings

- Adjust your lifestyle and expenses accordingly

- Avoid relying solely on pension plans or Social Security

How to Calculate Your Retirement Savings Goal

To determine how much you need for retirement, use this formula:

Retirement Savings Goal=Annual Expenses×Years in Retirement\text{Retirement Savings Goal} = \text{Annual Expenses} \times \text{Years in Retirement}

Step 1: Estimate Your Retirement Expenses

Your expenses will change after retirement. Consider:

- Housing Costs: Rent, mortgage, property taxes

- Healthcare Expenses: Medical insurance, treatments, prescriptions

- Daily Living Costs: Food, utilities, transportation

- Travel & Leisure: Vacations, hobbies, entertainment

- Taxes: Income tax, estate tax, capital gains tax

Step 2: Factor in Inflation

Inflation reduces purchasing power over time. Assume a 2-3% annual inflation rate when planning.

Step 3: Identify Your Income Sources

Your retirement income may come from:

- Social Security Benefits

- 401(k) or IRA Withdrawals

- Pension Plans

- Investment Returns (Stocks, Bonds, Dividends)

- Rental Income from Real Estate

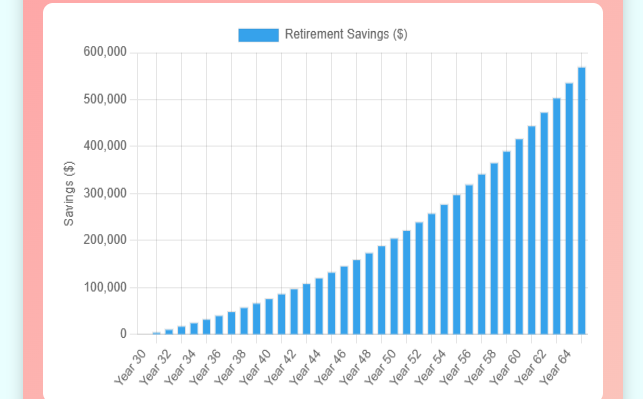

Step 4: Calculate Your Required Savings

Use a Retirement Planning Calculator to determine the gap between your expected income sources and your estimated expenses. The calculator will show how much you need to save and invest before retiring.

Key Factors Influencing Retirement Savings

1. Age of Retirement

- Retiring early (before 60) requires more savings.

- Delaying retirement (after 65) allows for longer investments and higher Social Security benefits.

2. Life Expectancy

- The longer you live, the more you need to save.

- Consider an average life expectancy of 85-90 years when planning.

3. Rate of Return on Investments

- Higher returns from stocks and mutual funds grow savings faster.

- Conservative investments like bonds and fixed deposits provide stability but lower growth.

4. Retirement Lifestyle Choices

- Living in a high-cost city vs. low-cost area impacts required savings.

- Travel, hobbies, and luxury expenses increase the needed retirement corpus.

5. Healthcare Costs

- Medical costs rise significantly post-retirement.

- Having a health insurance policy reduces unexpected financial strain.

How to Use a Retirement Planning Calculator

Steps to Use the Calculator

- Enter Current Age & Desired Retirement Age

- Input Current Savings & Monthly Contributions

- Estimate Annual Expenses & Expected Inflation Rate

- Select Investment Growth Rate (5%-8% recommended)

- Click Calculate to See Required Savings

Benefits of Using a Retirement Planning Calculator

- Accurate Financial Planning: Helps set realistic savings goals.

- Real-Time Adjustments: Update figures as your financial situation changes.

- Comparison of Investment Strategies: See how stocks, bonds, or real estate impact savings.

- Confidence in Retirement Readiness: Ensures you won’t run out of money.

Common Retirement Planning Mistakes

1. Underestimating Expenses

Many people fail to account for inflation, taxes, and unexpected costs, leading to financial shortfalls.

2. Relying Solely on Social Security

Social Security benefits may not be enough to cover all expenses. Additional savings and investments are essential.

3. Starting Late

The earlier you start, the more you benefit from compound interest. Even small contributions grow significantly over decades.

4. Not Diversifying Investments

Putting all money in one type of asset increases risk. Diversify between stocks, bonds, real estate, and retirement funds.

5. Failing to Adjust for Market Fluctuations

Economic downturns can impact investments. Regularly review and adjust portfolios for long-term stability.

How to Increase Your Retirement Savings

1. Maximize Retirement Contributions

- Increase 401(k), IRA, or pension plan contributions.

- Take advantage of employer-matching programs.

2. Reduce Unnecessary Expenses

- Cut down on luxury spending and debts.

- Reallocate savings into high-yield investments.

3. Invest in Growth Assets

- Stocks and real estate offer higher long-term returns than traditional savings accounts.

4. Delay Social Security Benefits

- Waiting until 70 years old increases monthly payments significantly.

5. Consider Passive Income Sources

- Dividend-paying stocks, rental properties, and online businesses generate consistent income post-retirement.

Conclusion

A Retirement Planning Calculator is an invaluable tool for securing your financial future. By calculating your savings goals, analyzing investment returns, and adjusting for inflation and expenses, you can build a comfortable retirement fund.

✅ Ready to plan for a stress-free retirement? Try our Sharks Tank Pakistan free Retirement Planning Calculator today! 🚀

Retirement Planning Calculator

Results

Estimated Retirement Savings: $0

By staying proactive and making smart financial choices, you can enjoy a secure, debt-free, and fulfilling retirement.