If you’re raising money — whether from angel investors, venture capitalists, or Shark Tank Pakistan — the biggest question is always the same:

📌 “How much equity am I giving away… and what will my ownership look like after the round?”

Most founders make this mistake:

They only look at the money coming in — not the cap table math.

Your valuation, investment amount, and existing ownership structure all change how much control you keep, how attractive your company looks to investors, and what future rounds will demand from you.

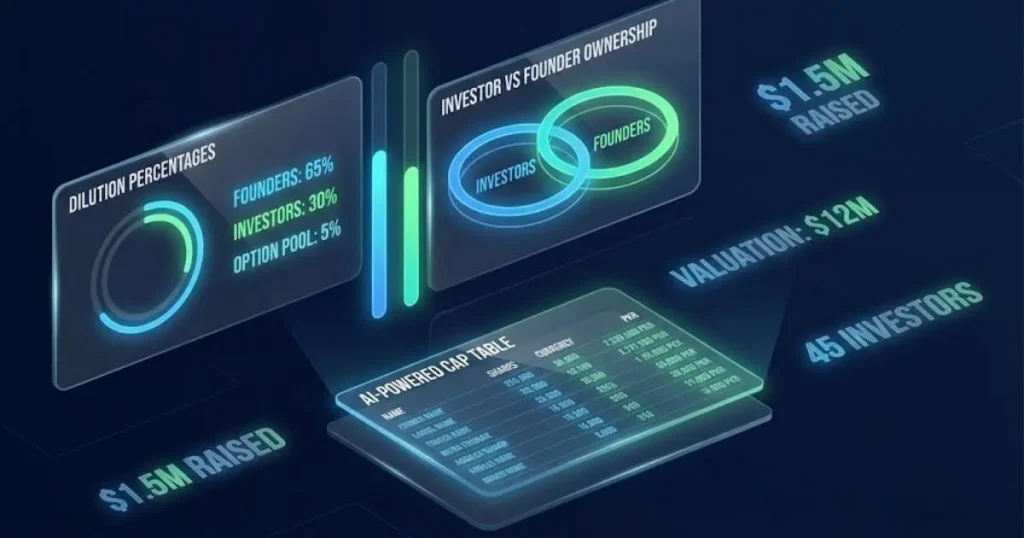

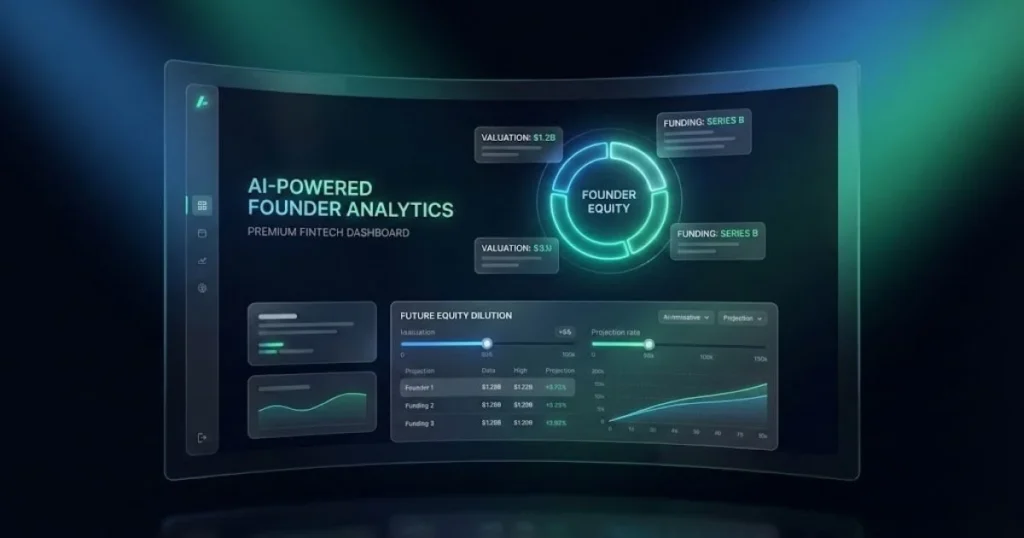

To remove confusion (and founder anxiety), we built the Startup Dilution Calculator , a premium tool that shows:

- 📉 Founder ownership before & after funding

- 📈 Investor ownership based on your deal

- 💼 ESOP & advisor allocations

- 💰 Post-money valuation

- ⚠️ Real founder dilution %

- 🎯 Whether the deal structure is healthy for future rounds

Let’s break down how dilution actually works, why it matters, and how to use the tool like a pro.

What Is Startup Equity Dilution? (Simple Definition)

Equity dilution means your percentage of ownership decreases when new shares are issued to investors.

Example:

- You own 100% today.

- You raise money and give 20% to an investor.

- You now own 80%.

Your company may now be worth more, but your slice is smaller.

This happens every time:

- you raise funding

- add co-founders

- create ESOP pools

- issue advisory shares

- run SAFE/NOTES conversions

- restructure your cap table

Dilution is not bad. Uncontrolled dilution is.

And that’s exactly why founder tools like this exist.

How the Startup Dilution Calculator Works (Beginner to Advanced)

Our tool asks for four inputs:

1️⃣ Pre-Money Valuation

Value of the company before new investment.

2️⃣ Investment Amount

Capital raised in the round.

3️⃣ Founders’ Equity Before Round

Your current ownership %.

4️⃣ Existing ESOP / Others

Advisors, team equity, or employee stock pool.

From these, the tool automatically calculates:

- Post-money valuation

- Investor ownership %

- Founders’ new ownership

- ESOP/others new ownership

- True dilution

- Founder control score

- TV-style headline deal (e.g., “PKR 1 crore for 10% of the company”)

Why Every Founder Should Calculate Dilution BEFORE Pitching

Investors look at your pitch through numbers, not emotion.

If your ownership is:

- Too high (90–100%) → You look inexperienced

- Too low (< 40%) → You look risky for long-term control

- Badly structured → Makes future rounds hard

A realistic early-stage control range is 55–80% for founders after a seed round.

Our tool instantly tells you where you fall.

Example: A Shark Tank Pakistan Style Deal

Let’s say:

- Pre-money valuation: PKR 80,000,000

- Investment asked: PKR 20,000,000

- Founders currently own: 100%

Calculation:

- Post-money valuation = PKR 100,000,000

- Investor gets 20%

- Founders now own 80%

Healthy. Clean. Investable.

Now compare this:

- Pre-money valuation: PKR 20,000,000

- Asking PKR 20,000,000

Investors now get 50%, instantly halving founder control.

The tool shows this visually so founders can reset their expectations before going on stage.

How Much Equity Should a Founder Give Away? (2025 Data)

According to global venture benchmarks:

- Pre-seed: 5–15% dilution

- Seed: 10–20% dilution

- Series A: 15–30% dilution

- Shark Tank style deals: 5–40% depending on traction

But here’s the real insight:

💡 Investors don’t care how much you give — they care how much you keep.

Founders with < 40% post-Series A are considered risky.

Use the tool to make sure you don’t drop below healthy control levels.

Top Questions Answered

1. How does startup dilution work?

Dilution happens when new shares are created and sold to investors. This reduces the ownership percentage of existing shareholders, even if the company’s valuation increases.

2. Is equity dilution good or bad?

Dilution is normal and expected. It becomes “bad” only when founders give away so much ownership that they lose control or create future fundraising problems.

3. How much equity should I give away to an investor?

Typical early-stage rounds dilute founders by 10–25%. Anything above 40% is usually considered risky unless the investor brings massive strategic value.

4. How do I calculate dilution manually?

Dilution % = (Investment / Post-Money Valuation) × 100

But this ignores ESOP pools and existing ownership — our calculator includes all variables.

5. What happens if founders own too little?

Low founder stake signals “lack of alignment,” reduces investor confidence, and makes future rounds harder.

“What is startup dilution in simple words?”

Startup dilution is when your ownership percentage goes down because new investors receive shares.

“How do I know how much equity to give?”

You compare your valuation, investment amount, and future fundraising expectations. Tools like the Startup Dilution Calculator show the exact percentage you should give without losing control.

“How does funding affect founder ownership?”

Every investment round reduces founder ownership, but ideally founders should retain at least 55–80% after seed funding.

“Is giving 20% equity too much?”

Not necessarily. For seed-stage companies, 10–25% is normal depending on traction and valuation.

When Should You Refuse an Investment Because of Dilution?

Say NO if:

❌ You fall below 50% too early

❌ Investor wants board control instantly

❌ You need two more rounds and are already at low ownership

❌ Investor contribution ≠ amount of equity demanded

Founders underestimate this, especially in Pakistan’s emerging ecosystem.

Use the tool before finalizing any negotiation.

Using the Dilution Calculator Before Shark Tank Pakistan

Before facing sharks like:

- Rabeel Warraich

- Faisal Aftab

- Taimur Malik

- Usman Bashir

…it’s crucial to test:

- Your valuation

- Equity ask

- Control after funding

- Future round scenarios

Sharks instantly detect founders who haven’t done this math.

Our tool prevents that mistake.

Try the Startup Dilution Calculator Now

💡 See your cap table visually.

💡 Understand how much equity you should give.

💡 Avoid giving away more than necessary.

👉 Use the tool at the top of this page and test real investor scenarios.

Final Thoughts: Own Your Story, Don’t Let Dilution Own You

Equity is the most expensive currency you will ever spend.

You only get one chance to pitch — but dilution lasts forever.

With the Startup Dilution Calculator, founders finally get:

- clarity

- confidence

- real control

- negotiation power

- fundraising readiness

And best of all…

You avoid the #1 mistake early-stage founders make:

saying yes to a bad

Pitching Soon?

Use this tool to refine your valuation before applying to Shark Tank Pakistan.

Try Funding Round Calculator →