An online price markup calculator will help you determine the final selling price by increasing the item’s original price by a Price-increased markup percentage. This simple lunchtime tool allows you to be fully transparent in your pricing while ensuring that you don’t cannibalize your business and protect your bottom line.

You need to factor in the markup that’s used to derive margins and other calcs specific to the industry. So, if you’re a retailer, service provider, or pricing for ecommerce, this tool will come in handy. Just plug in your expense and desired markup % into the calculator to get your retail price.

Selling Price Markup Calculator will give you the opportunity to calculate that ideal markup price to meet your objectives. This method simplifies complex multi-pricing schemes, freeing up time for more productive tasks. You’ll never have to do math by hand again!

Here’s how to use a wholesale price markup calculator to get maximum value. Here’s why this user-friendly tool is an invaluable resource for all businesses — large and mini.

What is Price Markup?

Price markup is used to determine the desired profit margin. It’s a simple calculation that determines the percentage difference between the cost to make a product and the desired retail price. It’s difficult for brands to understand because it’s a formula directly linked to their bottom line.

Markup is most often expressed as a percentage of cost price. It simplifies pricing by providing a simple method to calculate appropriate selling prices. For instance, if you purchase a product for $20 and markup it 50%, you would retail it for $30.

That translates into you raising the price by $10Price. Price guarantees that firms make sufficient economic profits to cover their average total costs. This provides them with plenty of enough wiggle room to profit themselves.

Define Price Markup

The formula used to calculate markup is markup = (selling price—cost) / cost × 100. This provides an unprecedented level of transparency into pricing that allows them to be proactive.

For example, if it costs you $15 to produce a product and you sell it for $30, you realize a 100% markup. That’s right—you’re essentially doubling your investment! This means the markup equals the profit, reinvesting the initial investment three times.

The majority of companies are cost-plus price setters. About three-quarters of them do it this way since it’s quick and easy and requires no complicated analysis.

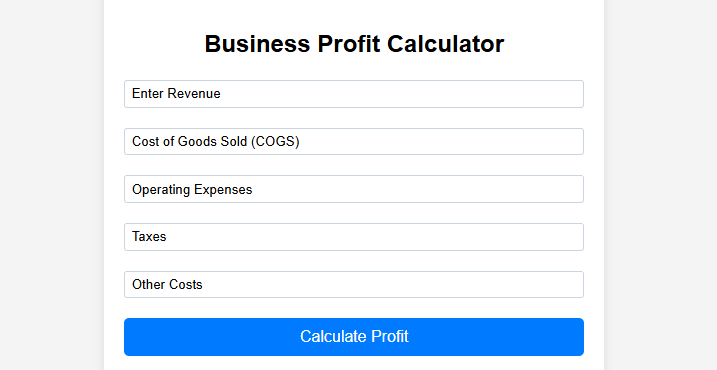

Price Markup Calculator allows you to calculate the correct price markup for your items quickly.

Why Markup Matters

The reason is that markup has a drastic effect on profitability and cash flow. An intelligently planned markup provides the greatest advantage. It ensures that your prices are in line with the market and adjusts as demand changes, such as during seasonal fluctuations.

Use the 50% markup as your starting point. Profitable honesty is key. This strategy leads to an ideal cost-to-profit ratio, where frankness and financial success meet. Understanding markup allows businesses to develop pricing strategies that adapt to market conditions.

Markup vs. Profit Margin

Markup is a cost-based metric, while profit margin is a revenue-based metric. For example, a 50% markup on a $20 cost would give a selling price of $30, resulting in a final profit margin of 33%.

Both terms are instrumental in planning for financial sustainability. Their alternate calculation methods serve very different purposes, each with specific intentions behind them, impacting how they should be used to shape pricing.

Price Markup Calculator: A Guide

Calculating selling prices is effortless with a price markup calculator. It takes all of your cost data into account and cross-references it with the profit margin you want to achieve. This tool is ideal for small businesses that adopt the cost-plus pricing strategy.

Almost three-quarters of businesses use this beaten, broken playbook. Automating these complex calculations can save your pricing team time and ensure optimum pricing accuracy. This is critical to ensuring that all businesses can achieve their profitability goals and continue to innovate, thereby remaining competitive.

1. Gather Cost Information

Start by figuring out each component of what you pay. This includes:

- Direct material costs (e.g., raw materials or supplies).

- Labor expenses (e.g., employee wages or contractor fees).

- Overhead costs (e.g., utilities, rent, or other indirect expenses).

Getting these costs filed properly is still critical. If you have a project with material costs of $100, labor costs of $50, and overhead of $30, then your entire cost is $180.

Diligence in creating proper, detailed notes on each calculation will serve you well the next time you need to re-compute later on.

2. Determine Desired Profit

Set a Profit Target.

Set a realistic profit target based on an understanding of the market and industry profit expectations. To use one, general contractors will typically target their profit margins between 8% and 15%.

Saving is just as significant. Today, profit is more directly linked to how you price. You choose to maintain a 10% profit margin above a $180 cost. This is how much you’ll figure in the extra cost, $18, to include in your net price.

3. Use the Price Calculator to input your price, markup, and profit percentages into the calculator.

The selling price can be calculated using the markup formula: Selling Price = Cost Price + Markup Price (decimal). This rule of thumb enables you to adjust values quickly.

4. Analyze the Results

Compare calculated prices to see how your prices are compared to other prices in your industry.

Most importantly, is it in line with your target profit margin? If your price markup is too aggressive, you may risk losing customers altogether. Pricing it too high, on the other hand, risks alienating the customer base.

5. Adjust as Needed

Fifth, adapt pricing in response to market reactions.

Keeping constant recalculation ensures that your profitability and pricing flexibility are both in good standing.

Key Components in Markup Calculation

The first step is to get the best markup calculation you can. This part of the process is crucial in finding the appropriate selling price that will help you achieve your business goals. The process begins by taking a very intentional look at each of these critical pieces.

Each of these pieces is critical to pricing your products appropriately. Understanding each element helps ensure you’re considering everything in the mix while remaining competitive at your desired price point.

Direct Material Costs

Direct material costs include any cost completely and directly associated with manufacturing a product. This mainly includes the value of materials and components that feed into the final product. Since these expenses form the foundation of your price markup calculation, it’s essential to track them appropriately.

Consider an example of a product you create with a $20 base price. At a 30% markup, the selling price would be $26. This leads to a $6 profit for every item sold. Recording material costs over the course of the project unveils interesting trends and insights.

It points out opportunities for savings, like volume discounts, when ordering in bulk.

Labor Expenses

Direct labor costs include salaries, benefits, per diem, and other employee-related expenses. These costs increasingly shape the bottom line, as failing to include them can result in underpricing.

In our scenario, labor contributes $15 to the retail price of thePriceuct. Price adds that to the $20 spent on materials, and your total production cost jumps to $35. At a 30% markup, that leaves us with a selling price of $45.50.

By vigilantly tracking your labor costs, you can ensure they stay congruent with your pricing structure.

Overhead Costs Explained

Overhead costs, also known as administrative costs, are indirect expenses like infrastructure, utilities, or salaries for staff not directly involved in programming. They must all be included, or else they will face extreme undervaluation.

Assuming overhead costs increase the total landed cost of a product from $35 to $45 because they add $10 to the total cost. At a 30% markup, the selling price increases to $58. That’s a significant increase!

Having inclusion of overhead is necessary if there is going to be any sustainable, long-term profitability.

Other Variable Costs

Shipping and packaging are variable costs that increase indiscriminately. Yet they affect the total costs set by the final markup calculator. Knowing where you make all of these expenditures is the first step toward avoiding phantom profit disappearing acts.

If their packaging adds $5, their costs cost goes to $45. A iskup on that price bringsPricer retailPriceing retail2.

Avoid Common Markup Mistakes

Effective pricing requires purpose and precision, yet an overwhelming majority of companies fall prey to miscalculations and errors when determining price markup. By knowing these five rookie errors for what they are, you can sidestep them and increase your bottom line. This understanding will allow you to make better markup price choices.

Ignoring Overhead Costs

One of the worst mistakes you can make is leaving overhead costs out of your markups. These costs include rent, utilities, and other overhead costs. While these expenses aren’t explicitly tied to what they produce, they significantly affect their profitability.

For example, simply applying a markup isn’t feasible when unique materials require specialized installation or monitoring. Neglecting these factors and failing to account for them can lead to underpricing while eating into your profits. A material plus labor-added approach is more protective.

As a rule of thumb, contractors can expect to mark up labor by at least 25% and materials by 30-50%. It incorporates every known overhead expense to create reasonable price models.

Not Considering Competition

The third pricing mistake is ignoring the competition. User experience consultancies can have trouble understanding competitors’ pricing practices. Neglecting to do a thorough market analysis results in either overpricing, sending potential customers to a competitor, or underpricing, which ultimately devalues your product.

Setting an item’s price to $9.Priceless creaPricee creates the illusion that it’s a better deal than its competitors. This approach gradually chips away at your markup and profitability. Make sure to track your markup compared to your competitors very closely.

This proactive strategy allows you to stay ahead of your industry evolution while ensuring a sustainable markup for your profitability.

Failing to Track Results

Finally, failing to rigorously report on the outcomes of approved new or increased pricing experiments is an enormous missed opportunity. Tracking sales and profitability can provide valuable insights to better inform future decisions.

That’s why it’s crucial to know the difference between markup and margin. In actual practice, a 50% margin translates to a much higher final selling price than a 50% markup, which can leave thousands of dollars in sales on the table.

Show them how to avoid these five fatal pricing fails. Let hard sales data help you find ways to keep improving and innovating. Dynamic pricing might be the better solution.

Customize for Different Business Models

Shifting strategy markup strategies to fit your unique business model type is essential for long-term sustainable profitability. There is no magic formula—every industry’s circumstances vary. By deeply comprehending these differences, businesses can strategically and competitively price their offerings.

This helps ensure that their ticket prices remain consistent with the cost of their operations and the market expectations. Let’s explain this in more detail.

Retail Markup Strategies

For retailers, pricing decisions are a daily balancing act between being inexpensive enough to win the sale and profitable enough to stay in business. Fashion retailers generally work to a 50%—1000% markup. On-demand returns use a 25% average price markup back to the resold object, such as a smartphone returned on-demand using a 25% electronics resell.

Grocery stores operate on much tighter margins, often in the 1% – 3% range per item. These differences highlight the necessity of providing room for wiggle. Retailers can determine their ideal pricing by testing various price markups.

They can shift how they price depending on the category of product or the level of demand, or lack thereof, from consumers. I should have figured that out. Luxury items such as fine jewelry typically have an 80% markup or higher. This steep cost is indicative of their scarcity and the high-profile clients that pursue them.

Service-Based Business Markups

In other words, service-based businesses should sell themselves on things like their labor and overhead. Unlike retail, where the price is the price, in this case, perceived value is king. A top-tier spa destination, for example, might justify and even encourage premium pricing through specialization and an elevated experience.

Being open with your customers about the added value you provide goes a long way in earning their trust. That trust allows them to demand more aggressive markups. Be sure to calculate your costs accurately to protect your bottom line.

In this manner, you can offer your clients desirable pricing.

Manufacturing Markup Approaches

For manufacturers, rigorous cost tracking is not a choice. Direct material and labor costs are the foundation of savvy pricing strategies. Bulk purchasing is one strategy to save money and boost margins without skimping on quality.

Furthermore, this tactic is particularly powerful in fields known for high price sensitivity—a hallmark of the consumer electronics industry.

Dynamic Factors Affecting Markup

Markup decisions are affected by a wide range of dynamic external factors that can complicate when and how markup is calculated. By understanding these factors and adapting accordingly, businesses can optimize gross profit margins while maintaining competitive pricing strategies.

Fluctuating Material Costs

These costs continue to rise due to ongoing supply chain disruption and economic turmoil. Moreover, suppliers frequently raise their prices, which further increases costs. These ups and downs have a direct impact on how markup is calculated and pricing strategy as a whole.

That’s just essential arithmetic, folks! If materials just go up by 7% to 10%, keeping the same markup means having less margin in profits. Making a habit of checking supplier prices can keep you in tune with what the market costs are today.

This practice further removes the unpredictable nature of these losses. A Simple Markup Calculator can help you quickly account for these factors and mark up accordingly. It calculates the best possible selling price for you based on what you’re paying now and what margins you want to achieve.

By managing the forecasting and model material costs, firms can significantly reduce exposure by removing unexpected pricing shocks.

Competitive Pricing Pressures

Third, the role of competition as an explanatory driver of markup should not be understated. Businesses need to strike a careful balance between profitability and competitiveness in the marketplace. In the retail apparel and fashion industry, discriminatory markups of 2.5 are par for the course.

Go in the opposite direction of this accepted standard and you’ll boost sales significantly. Monitoring competitors’ pricing strategies allows you to know when to make your move and take informed action.

Armed with cloud financial solutions like Sage Intacct, businesses get multi-location, real-time visibility. This helps them feel confident they can continue to provide value with consistent, data-driven pricing decisions.

Seasonal Demand Swings

For instance, if your products see higher demand during certain seasons, you need to create seasonal pricing models. During busy times, peak season markups can take advantage of the heightened demand.

Lower markups can help stimulate sales during off-peak hours or seasons. Designing and recalibrating historical sales data creates more accurate forecasting and increases the probability that pricing matches consumer expectations.

It’s much easier for retailers to apply an arbitrary 14% markup across the board. This process also makes it easier to do seasonal price updates, particularly for more seasonal items.

Markup Calculator vs. Fixed Formulas

Creating smart pricing strategies, like applying a general parts markup calculator, is central to any profitable business. Calculating markup vs a flat formula: The best option for you will depend on your circumstances. Both approaches have unique advantages and can work hand-in-hand to get you to the right price to maxPrice profitaPricey.

Benefits of a Calculator

Whether you run a small, medium, or large business, a markup calculator offers excellent benefits, particularly for companies with more extensive inventories. Calculators are a wonderful, flexible tool. Because of this flexibility, they can rapidly recalibrate input costs and shifts recalibrate margins in real-time, unlike static formulas.

It’s really easy with a calculator; say you want to figure out what markup to put on an item that costs you $5.00. Just enter a 50% markup and see the selling price instantly jump to $10.00! For example, if you need to maintain a 50% margin, the calculator helps you do half the work. Increasingly simply, it works backward from your desired profit objective.

Perhaps the biggest advantage is time-saving efficiency. Updating prices manually for hundreds of products weekly can take hours, but a markup calculator automates this task, streamlining the pricing process. Intermediate calculations, such as converting margins into markup, become trivially easy.

This eliminates discrepancies and boosts bottom-line profitability. Businesses that implement this type of technology will be able to implement improved, more precise pricing with much less opportunity for “human error.”

When to Use Fixed Formulas

Though calculators offer great advantages, there are still cases where a simple fixed formula is better suited for the context. Formulas offer consistency for basic price markup formulas.

Take, for example, a made-up café owner who consistently applies a flat 50% markup to all their menu items. These tools work well at producing the most effective advances for companies with minimal product sophistication. They are simple, uniform across the market, and require no other hardware to adopt.

Variable Pricing and the Calculator

A price markup calculator is an invaluable tool for companies introducing variable pricing. It allows space for uncontrollable factors, such as increasing expenses, emerging market needs, and evolving customer expectations.

By doing so, you’ll find it much easier to determine your ideal selling price. Quickly choose your selling price with the Selling Price = Unit Cost × (1 + Markup Percentage) formula.

With this method, you can safeguard your profit wish targets. This flexibility is essential in a competitive market, where responding swiftly to changes can impact profitability.

Promotional Discounts

Many marketers employ promotional price markups to attract new customers. These discounts can make markup calculations difficult.

The markup calculator lets you experiment with incorporating discounts without damaging your bottom-line profit. Consider a standard product that wholesales for $5 and retails for $10.

If you’re planning to provide a 20% discount, you can quickly calculate the required markup percentage with the calculator. This ensures that even during discounting, you’ll be making a profit.

Book your markdown promotions in advance with a proven approach! This strategy allows you to take home incremental sales today—all without putting your future growth at risk.

Bulk Pricing Strategies

Bulk pricing may be one of the best ways to attract these value-minded customers. By offering variable pricing and discounts for larger purchases, businesses incentivize larger purchases while increasing overall sales volume.

Though this tightens profit margins, it significantly increases the necessity of accurate price markup calculations. Selling a multi-pack of five items for a lower per-unit cost involves a lot more math.

Use your price markup calculator to ensure accurate adjustments and profitability. Understanding customer purchasing patterns can further advance these tactics.

Accommodate Sales and Promotions

Deep, temporary price cuts usually drive sales events to drive volume. Changing markups during these times is of utmost importance.

A calculator makes the process much easier. Perhaps most importantly, it helps businesses understand their profitability as they scale.

That’s what keeps their growth healthy and sustainable.

Reverse Markup: Calculate Cost

Reverse markup is a simple method for calculating a retail product’s markup price. It’s not hard to calculate it quickly using your cost price and markup percentage. This strategy forces firms to obtain an accurate snapshot of their cost drivers.

As a result, they’re able to implement more informed pricing strategy decisions and improve their overall financial forecasting. Reverse markup goes from the bottom up to check everything’s correct. This allows you to confidently make pricing decisions based on proven data, not guesswork or trial and error.

What is Reverse Markup?

Reverse markup is calculating the cost of goods using the reverse markup formula. In short, it allows you to figure the cost price from your selling price with the markup % you’ve entered.

For instance, if a product is sold at $130 with a 30% markup, the original cost can be calculated using the formula C = PF / (1 + M). C is the original cost, PF is the final price, and the price is the price as a decimal.

If we work backward from this, the actual original cost is $130 /(1 + 0.30) = $100. This methodology allows businesses to be transparent about their pricing decisions, better understand their cost structures, and improve their overall financial picture.

In industries such as automotive and retail where markup varies widely, this multiplier effect is especially potent.

Calculate Original Cost

To calculate the original cost, apply the formula: original cost = selling price / (1 + markup percentage). For example, if a product retails for $50 and has a 50% markup percentage, you can easily find out the cost.

To calculate the original price, simplPriceide $50 Price50 or $50/1.50=$33.33. Consistently re-evaluating costs encourages more competitive pricing and promotes the continued flow of effective, valuable inventory.

Industries like automotive are now entirely reliant on this data. Markups for regular cars are typically just 5-10%, but for luxury performance vehicles, they occasionally exceed 30%.

Conclusion

Pricing decisions have the most significant and most lasting power to affect the trajectory of your business. A price markup calculator takes the uncertainty out of the equation. It provides you with accurate, reliable, and unbiased data to help inform your decision-making.

From here, you can begin to account for shifts in the market, changing customer requirements, and your own specific goals. This goes beyond simply needing to recoup costs—it’s an increasingly urgent survival requirement for maintaining long-term competitiveness and profitability. By prioritizing the most current data and billing capabilities, you eliminate missteps that could be hurting your bottom line.

Every business has unique challenges, and studies such as this one help to further define those challenges. Improve your strategy or make a fresh start! Whether you’re implementing an aggressive or modest markup strategy, being informed will increase confidence in your company’s pricing.

Avoid future headaches by ensuring that your calculations are as perfect as possible and getting out in front. A robust markup strategy will provide your business with a solid growth base and allow it to thrive for years to come.

✅ Ready to fine-tune your pricing strategy? Try our Sharks Tank Pakistan free Price Markup Calculator today and unlock the potential of smart pricing! 🚀

Price Markup Calculator

Selling Price: $0.00

Frequently Asked Questions

What is a price markup calculator?

That’s why a price markup calculator is a key asset for any business. It finds the selling price of a product by working out the selling price through the markup formula, including the cost price plus your percentage gross profit margin. This helps you price your products correctly.

How is price markup different from profit margin?

First things first, let’s discuss how to calculate markup. It’s the percentage markup over the cost price to get the final selling price. Profit margin is a measure of how much profit you make on sales.

It is the gross profit margin as a function of the total selling price. Though both are close cousins, they are invaluable resources calculated in very different ways.

Why is markup significant for businesses?

Calculating markup ensures that a business covers all its expenses and achieves desired gross profit margins. This systematic approach prevents the price from being profitable while still competitive within the market.

When businesses use the proper markup approach, they experience a massive increase in their bottom line. This approach saves money and builds customer trust in the retail company.

Can I use a price markup calculator for different industries?

A price markup calculator is an essential, multifaceted business tool. You can customize it for any industry, such as retail, wholesale, and service-based businesses.

Simply edit the operating expenses and refigure profit markups to see the impact.

What are common mistakes to avoid in markup calculation?

Stop referencing outdated prices, excluPricehidden fPrice, or drawing solely on inflexible calculations. Account for other dynamic variables to ensure you’re calculating your markup correctly.

Competitive pricing strategies and overall market trends are the most significant factors in this equation.

How does a markup calculator benefit small businesses?

Smaller businesses can make everyday pricing decisions more straightforward with a quick commercial parts markup calculator. This tool improves efficiency and decreases errors, allowing owners to quickly and accurately price to maintain profitability.

What is reverse markup, and how is it calculated?

Reverse markup is an important business tool. Knowing the selling price and the markup percentage can help you determine the cost price.

This approach allows businesses to describe tradeoff space, identify competitive price strategies, and potentially revise price structure more competitively.

By leveraging these insights and tools, you can set prices that not only cover your costs but also maximize your profit margins, ensuring long-term business success.