Compound Interest Calculator

Visualize your financial growth

| Year | Balance | Interest |

|---|

A simple compound interest calculator will give you an idea of how much your money can grow just by reinvesting the interest that you earn. It’s a simple tool that shows how initial investments, additional contributions, interest rates, and time work together to increase your savings or investments.

A deeper look into the numbers paints a broad-strokes picture of the possible return on investment. Understanding this effect gives you the power to make better financial choices. Whether you’re planning for retirement, saving for a major purchase, or building an emergency fund, this calculator is an essential resource.

We’ll take a closer look at how to go about doing that in the following sections. You’ll learn what to look for and how to earn the most compound interest with our simple and free compound interest calculator with ease.

What is Compound Interest?

With compound interest, you can earn interest on your starting deposit, called your principal. It allows you to make money off the money you’ve accumulated interest on, which continues to compound over time. This has a snowball effect, with your savings or investments increasing at an ever-quickening pace.

While simple interest is calculated solely on a principle, compound interest accumulates on itself. That’s what leads to that incredible exponential growth over just a short period of time.

1. Define Compound Interest Simply

In other words, the magic of compound interest is that by periodically adding the interest to the principal, it begins to earn money on its money. For example, if you invest $1,000 at a 5% annual interest rate and compound it yearly, you’ll earn $50 during the first year.

See your money increase with this terrific investment strategy! So in the second year, the interest is earned on $1,050, producing an interest payment of $52.50, and so forth.

As time goes on, this compounding effect can make a huge difference in building your wealth—particularly when you start young. You can imagine it like taking a snowball and rolling it down a hill—the further it goes, the faster it picks up new snowflakes and the bigger it gets.

2. How Compounding Creates Exponential Growth

As you can see, time is an essential part of compounding. For example, if you invest $100 per month from age 20, you would have more than $880,000 by age 60. All of this is based on a 10% rate of return.

Saving instead starting at age 30 would result in under $25,000—less than half of that total. This compounding effect is what makes compound interest so necessary to accomplishing long-term financial goals.

Once you understand this magical concept, you can make smart choices about when to save and when to invest.

3. Why Compound Interest Matters

We think compound interest is one of the cornerstones of personal finance. It’s not just about savings; it applies to loans, credit cards, and the use of money over time in financial planning.

When you add it to your approach, you not only grow wealth faster, but you reduce debt more efficiently.

4. Compound Interest in Personal Finance

Compound interest calculators break down the math behind more complicated formulas such as P = C (1 + r/n)nt. They are used to calculate future investment worth or overall loan repayment amounts so you know how to plan financially.

Simple interest is a straightforward formula. It doesn’t take advantage of the magic of compounding, so it’s better for shorter-term borrowing needs.

Compound vs. Simple Interest

Understanding the difference between compound and simple interest empowers you to make informed financial choices. While both involve earning or paying interest, the calculations, particularly compound interest calculations and their impacts over time, can significantly affect your savings goal and total deposits.

Explain Simple Interest

Simple interest is calculated only on the principal amount, using the formula:Simple Interest = P × r × t, where P is the principal, r is the interest rate (as a decimal), and t is the time in years.

To illustrate, if you borrowed $10,000 at a 5% annual interest rate, you’d owe $1,500 in interest after three years. This is determined by taking $10,000, multiplying by 0.05, and then multiplying by 3.

This approach is common on short term loans, car loans or personal loans where clarity and simplicity are important. It doesn’t provide anywhere near the same potential for exponential growth that compound interest does. That’s because it does not account for interest on previously accrued interest.

| Aspect | Simple Interest | Compound Interest |

|---|---|---|

| Formula | P × r × t | P × [(1 + i/n)^(nt) – 1] |

| Growth | Linear (based on principal only) | Exponential (principal + accrued interest) |

| Use Cases | Short-term loans | Long-term investments |

Key Differences Summarized

Compound interest is preferable for long-term goals like retirement savings or college funds because of its ability to grow faster.

For instance, an investment with an 8% annual return doubles in nine years as a result of compounding. Simple interest is more appropriate for clear, easy-to-understand, short-term situations such as a two-year car loan.

It’s important to choose the right type based on your timeline and what you hope to grow into.

When to Use Each Type

The formula for compound interest, P × [(1 + i/n)^(nt) – 1], highlights how principal, rate, compounding frequency, and time interact.

An example of how powerful long-term compounding is: A 25-year-old who saves $6,462 per year growing at 6% CAGR will have over $1 million by the age of 65.

Understand Compound Interest Formula

Compound interest helps maximize your investment by adding your earned interest back into the principal. This strategy will enable your investment to grow exponentially in value over time.

The formula, A = P (1 + r/n)nt – P, breaks this down into key components: P (principal), r (annual interest rate), n (compounding frequency), and t (time in years). Getting to know each factor’s function is essential to understand how compound interest works.

Identify the Core Components

The principal (P) is the initial amount. For example, if you start with $1,000, this is your principal to earn interest on.

The interest rate (r) is in decimal form, therefore 5% = 0.05. Compounding frequency (n) determines how many times per year interest is compounded. Common choices are daily (365), monthly (12), or yearly (1).

Lastly, time (t) affects how long the principal will have compounded interest accruing. To illustrate this, consider investing $1,000 at an annual interest rate of 5% compounded over two years. For quarterly compounding (n=4), the resulting accumulated interest compounds faster than with annual compounding.

Explain the Formula Step-by-Step

To do by hand, we’ll work backwards, starting with P. Calculate the balance after the first period of interest by applying (1 + r/n).

So for instance, $1,000 compounded quarterly at 5% would grow to $1,012.50 after three months. That new sum is now the principal for the upcoming quarter, and the cycle continues.

Calculate Manually with Examples

Daily compounding gives you more return than monthly or yearly. For $1,000 invested at 5% for 1 year, annual compounding would earn $1,050 but daily compounding would yield $1,051.27.

Each of these approaches illuminates the ways that frequency affects growth and playing catch-up.

How Compounding Frequency Affects Growth

Compounding frequency can have a significant impact on growth. Compounding frequency is the number of times per period interest is applied to the principal balance. This much overlooked, but fundamental idea is what makes the difference between having a valuable nest egg or slowly losing everything you saved over time.

By understanding how compounding frequency impacts growth, you can help maximize your returns and reach your financial objectives sooner.

Define Compounding Frequency

That’s because the frequency of compounding affects how many times your interest accumulates interest. Here’s a breakdown:

- Daily Compounding:

- Pros: Generates the highest returns due to frequent calculation.

- Cons: Typically associated with fixed instruments like CDs, which may limit early access to funds.

- Monthly Compounding:

- Pros: Offers a balance between higher returns and flexibility, as seen in savings accounts.

- Cons: Slightly less profitable than daily compounding.

- Annual Compounding:

- Pros: Simpler to calculate and understand.

- Cons: Yields the lowest growth among the three.

For instance, investing an amount of $1,000 at 5% interest per year will accumulate to an approximate value of $1,051.16 with annual compounding. With monthly and daily compounding, it will grow to about $1,051.27 after one year.

Daily vs. Monthly vs. Annually

The more often you compound, the faster you grow. Intra-year compounding essentially takes the annual stated interest or rate and divides it into compounding periods smaller than a year, compounding within those periods.

For example, if $100 is invested every month starting at birth, at 5% annual interest compounded monthly, the total grows to $13,272 by age 60.

Impact on Investment Returns

The best way to get accurate numbers is by plugging your values into a compound interest calculator. Make sure to enter data accurately—interest rate, compounding frequency, number of years—so you can understand any resulting output.

Tools such as these demonstrate the power of changing compounding frequencies and how they magnify your returns.

Use a Compound Interest Calculator

Using a compound interest calculator online will allow you better to understand the potential future value of your investments. It considers your initial amount, interest rate, compounding schedule, and overall period.

In short, we hope to show you how the power of compounding can supercharge your savings. With this understanding, you can better strategize to reach your financial goals, such as retirement or a big purchase, efficiently.

Here’s a rundown on how to use one to maximum effect.

Find a Reliable Calculator

First things first, choose a reputable calculator to start with. Find easy compound interest calculator tools. Look for calculator tools provided by trusted financial institutions or sites known for precise, easy-to-use resources.

They’re often examples like calculators from financial institutions or investment firms, think Bankrate or NerdWallet. These tools usually enable you to adjust factors such as compounding frequency and regular contributions.

Try out a bunch to get a sense of which one might suit your needs.

Input Initial Investment Amount

Enter your starting deposit accurately, since this will set the stage for how much you can grow your money. For example, an investment of $5,000 with a 5% annual interest rate will double in approximately ten years.

By comparison, an otherwise identical $2,000 investment will grow a lot less. The higher your starting amount, the more you’re generally able to earn in returns.

Enter Interest Rate and Time Period

Enter the annual interest rate as a decimal (i.e. 5% = 0.05) and enter how many years you plan to invest. Longer time horizons and higher rates of return increase the effects of compounding.

A 6% rate of return over 20 years will result in significantly greater accumulation than that of a 3% rate of return over the same 20 years.

Factor in Additional Contributions

Including regular deposits, such as $100 monthly contributions, enhances the compound interest calculations, significantly increasing total returns over time compared to a one-time deposit in a savings account.

Interpret the Results Accurately

Look at the output with a critical eye. The right calculator will even walk you through key concepts like total interest earned and how your contributions affect overall growth.

Use this knowledge to save in multiple scenarios and adjust your plan to be more effective.

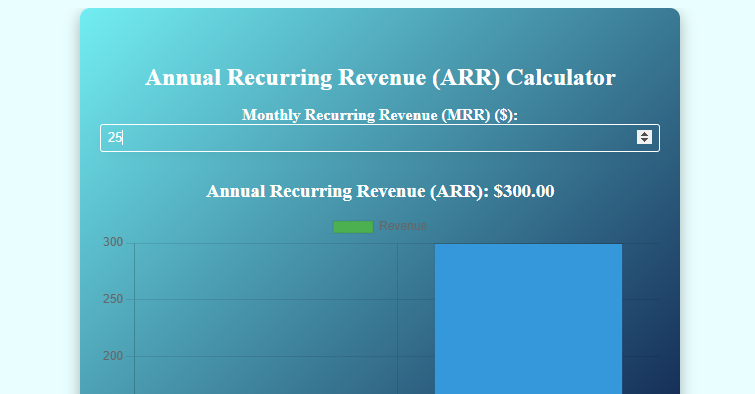

Annual Compound Interest Calculator

Annual calculators are best at straightforward calculations for compound interest calculations. If your investment does compound more often, ensure to use calculators designed for monthly compounding intervals.

Optimize Your Strategy

The earlier you start investing and the more consistently you make additional deposits, the greater your growth potential will be. Even small regular deposits can lead to significant savings balances over time, as the calculator clearly demonstrates.

Maximize Compound Interest Benefits

We know that the key to maximizing compound interest benefits is time and consistency. Contribute regularly, ideally automatically, so you don’t miss any opportunities to invest. Those small contributions can turn into significant amounts of wealth over time.

By appreciating what it can do and what it can’t do, you can better tailor your financial strategies to maximize its long-term impact.

Start Investing Early

The sooner you get started, the more time your money has to grow. For example, if you begin at 25 with USD 200/month at a 6% annual return, you’ll accumulate over USD 285,000 by age 60. If you wait until 35, it drops this down to nearly USD 148,000.

There’s more. Reinvesting those dividends — in other words, reinvesting earnings — compounds the positive effects and supercharges growth. Dividend Reinvestment Plans (DRIPs) take care of that automatically, having every dollar do more work for you.

Warren Buffett and most successful investors will tell you that a large part of their success comes from starting early and consistently reinvesting their earnings.

Reinvest Your Earnings

Investments with greater returns, such as stocks or corporate bonds, increase the power of compounding. A properly diversified portfolio manages risk and enhances potential for returns.

For example, blending high-yield equities with sovereign debt provides the double benefit of capital appreciation and steady cash flow. From the frequency of compounding, choosing the frequency with which your interest is compounded—daily, monthly, etc—makes a difference on returns.

That’s because daily compounding creates more than annual, thanks to the compounding effect from reinvesting every single day.

Stay Consistent Over Time

Having a regularity or consistency to contributions is very important. Regular deposits, such as an automatic transfer of USD 200/month, develop a savings habit and compound overall growth.

Automated deposits make this much easier, lessening the urge to forget to do it. Discipline keeps you focused and prevents rash decisions, especially when the market gets rocky.

That kind of persistence over decades turns small monthly contributions into large college savings totals.

Choose High-Yield Investments

Compound interest is powerful when it comes to building wealth—from high-yield savings accounts to 401k retirement plans. Real-world applications, such as 401(k) retirement plans, stress its importance in attaining financial freedom.

Maximizing compound interest benefits leveraging this idea with intentional, proactive approaches fosters long-term, stable growth.

Real-World Applications

In that vein, understanding compound interest calculations is perhaps the most significant aspect of the financial literacy movement. Knowing what it can and can’t do is key to using it effectively to support your savings goals and interests.

Compound Interest in Savings Accounts

Bank savings accounts typically use compound interest to increase your money over the years. Fortunately, a high-yield savings account can pay interest at as much as 4% annually, compounded monthly. That can really increase your earning potential over a basic account with a much lower interest rate.

Take for example a deposit of $10,000. If this is compounded monthly at 4%, it could accumulate to about $12,486 after five years. Shopping around between different banks or credit unions can reveal accounts that offer superior interest rates and compounding frequencies so that money is growing in the best possible way.

Compound Interest in Retirement Planning

Retirement accounts, such as 401(k)s or IRAs, use the power of compound interest to create long-term upward fiscal mobility. Early contributions make up for that growth due to the power of compounding.

For instance, investing $5,000 annually from age 25 to 35 at a 7% annual return could grow to over $600,000 by retirement, even with no further contributions. Education savings tools such as 529 plans similarly harness compounding to grow savings for future education costs, shielding families from wealth eroding due to inflation.

Compound Interest in Mortgage Payments

Compound interest impacts mortgages by determining total interest paid over time. A $300,000 30-year loan at 5% interest would lead to more than $279,000 in interest payments.

Since interest is accrued on the remaining balance, making additional payments to lower the principal saves money in the long run by decreasing the compounding effect.

Compound Interest in Bonds

Bonds, like Series I bonds, compound semiannually, ensuring you receive reliability in the return. Including bonds in your portfolio helps balance risk while leveraging compound interest calculations to grow your savings balances.

Account for External Factors

This is where the emergence of online compound interest calculators comes in handy for accurate compound interest calculations. Further consideration for investment returns is vital with outside factors at play. Failure to account for these factors may distort the view of how your total deposits will appreciate or depreciate in the future.

Consider the Impact of Inflation

Inflation decreases the purchasing power of money. The same amount of money will buy you less in the future. For instance, $100 today may only have the buying power of $90 in ten years if inflation averages 2% annually.

Consider inflation when calculating compound interest. It’s crucial to factor in inflation to get a picture of what the real returns will be. 6% per year is not as impressive as you might think. When you account for, say, a 2% inflation rate, your real return is more like 4%.

Failing to account for this means you’re likely overstating how much wealth you’re accumulating.

Understand Tax Implications

Taxes are one of the biggest factors that can decimate the power of compound interest. Earnings in a taxable account could face a double whammy. This decrease happens either through capital gains taxes or income taxes depending on the type of investment.

Tax-efficient strategies, such as contributing to a Roth IRA or 401(k), allow investments to grow tax-free or be taxed at a lower rate upon withdrawal. When you plan for taxes, you’ll get the most out of your returns and dodge those surprise cut downs.

Adjust for Changing Interest Rates

Interest rates affect how quickly investments will appreciate. A 5% return will grow exponentially quicker than a 3% return. Rates can change overnight with shifts in the economy.

Reviewing investments annually and adapting to trends like moving funds into higher-yield accounts helps maintain optimal growth.

Common Mistakes to Avoid

When utilizing a compound interest calculator, it’s easy to make minor miscalculations that affect your total deposits and future interest, resulting in inflated results and lost growth potential. By knowing these common mistakes, you can set yourself up to realize the most potential.

Neglecting to Reinvest

Reinvesting our interest and dividends are absolutely key for unlocking the full power of compound interest. By not making these reinvestments, you forgo the chance to earn returns on that growing principal thereby impacting your returns going forward.

So, for example, let’s take an investment of just $5,000 and assume a 6% return compounded yearly. If you reinvest that $500, your balance will exceed $16,000 in 20 years. If you took out the annual interest, you would be left with only $11,000, severely cutting into your profits.

Again time is the name of the game. The earlier and more consistently you reinvest, the more compounding impact you will have.

Underestimating Time’s Impact

Time amplifies compound interest, but it magnifies overlooked risks like inflation and taxes. A 3% yearly inflation rate just slowly eats away at your buying power.

That means in 30 years, your $100,000 could shrink to roughly $40,000 in today’s dollars. Taxes eat more of your returns, and it’s compounded if you’re in a higher tax bracket.

To combat this, use tax-advantaged accounts such as IRAs or 401(k)s and invest in inflation-beating assets.

Ignoring Inflation and Taxes

Not accounting for things staying the same, such as an interest rate set in stone or annual compounding, can result in serious miscalculations. For instance, applying the Rule of 72 to interest rates over 10% results in significant inaccuracies in calculating time to double.

Likewise, not calculating the effective interest rate or not accounting for changes in compounding frequency can lead to misleading results. Finally, make sure your calculations always correspond with the physical world to produce results that are relevant, useful and actionable.

Conclusion

Knowing how compound interest works can greatly improve your financial success. It provides you with a simple, predictable tool to increase the return on your savings, effectively pay off debt, or build assets through safe investing. Using a compound interest calculator can help you better visualize the numbers. You can run multiple scenarios and see what will get you the closest to your goals.

Even small changes, such as increasing contributions or strategizing to select the optimal retirement account, can translate into significantly higher savings in the long run. Preventative measures and staying mistake-free help put you ahead of the game.

By being informed and taking the initiative to make sound financial decisions you can take control of your financial future. The magic of compounding is most effective when you begin young and maintain consistency. Apply the ideas, tools, and know-how to start making more informed money moves—starting right now.

💡 Want to see how fast your money can grow? Try our free Compound Interest Calculator👇 today on Sharks Tank Pakistan! 🚀

Compound Interest Calculator

Results

Future Value: $0

Frequently Asked Questions

What is a compound interest calculator?

A compound interest calculator is a tool that helps estimate how much your investment or savings balances will grow over time with compound interest calculations. It simplifies the math behind compound interest and illustrates how much your money can grow with regular deposits under the right conditions.

How does compounding frequency impact growth?

Compounding frequency refers to the number of times interest is calculated and added to your savings account balance during each compounding interval. A higher compounding frequency, such as daily rather than annually, accelerates your total compound interest earnings through the 'interest-on-interest' phenomenon.

What is the formula for compound interest?

Formula for Compound Interest

Where:

- A = Final amount

- P = Initial principal

- r = Annual interest rate (as a decimal)

- n = Number of times interest is compounded per year

- t = Number of years

Example Calculation

If you invest $10,000 at an annual interest rate of 5%, compounded monthly for 10 years:

After calculation, the total amount will be $16,470.09.

Why should I use a compound interest calculator?

Using a calculator can save you time and provide the most accurate results for compound interest calculations. It is especially useful in understanding growth scenarios, comparing financial options, and making informed decisions about your savings account and achieving your savings goals.

How can I maximize compound interest benefits?

Getting ahead, starting early, and investing consistently in accounts with higher interest rates that offer frequent compounding intervals will provide you with a significant advantage over time. To achieve your savings goal and grow your money quickly, reinvest your earnings for additional interest.

What are common mistakes to avoid with compound interest?

Just like the above examples in making regular withdrawals too soon, ignoring fees, and underestimating the impact of compounding intervals, all of these errors can add up, resulting in much less money than you could be making.

Can external factors affect compound interest growth?

Of course, inflation, taxes, and other market fluctuations will take a toll on your growth, impacting your total deposits and savings goal. Include these in your plan so you know what to expect and don’t set yourself up for failure.