Introduction Car Loan EMI Calculator

A Car Loan EMI Calculator is a vital tool that allows individuals to estimate their monthly car loan payments accurately. Whether you are purchasing a new or used car, understanding your Equated Monthly Installment (EMI) before applying for a loan helps in financial planning and ensures better decision-making.

This comprehensive guide explains the workings of car loan EMIs, how they are calculated, factors affecting them, and strategies to secure the best loan terms. Additionally, we will explore other financial tools available on SharksTankPakistan.pk that can assist in making better financial decisions.

What is a Car Loan EMI Calculator?

A Car Loan EMI Calculator is an online financial tool that determines your monthly repayment amount based on key loan parameters such as:

- Loan Amount – The total sum borrowed from the financial institution.

- Interest Rate – The percentage charged annually by the lender.

- Loan Tenure – The repayment duration, typically in months or years.

By using this calculator, borrowers can assess different loan scenarios and choose a repayment plan that fits their financial situation.

Car Loan EMI Formula

The EMI for a car loan is calculated using the following formula:

EMI=P×r×(1+r)n(1+r)n−1EMI = \frac{P \times r \times (1+r)^n}{(1+r)^n – 1}

Where:

- P = Loan Amount

- r = Monthly Interest Rate (Annual Rate / 12 / 100)

- n = Loan Tenure in Months

This formula ensures that each EMI consists of both principal and interest components, with the interest reducing over time as more principal is repaid.

How to Use a Car Loan EMI Calculator?

Using a Car Loan EMI Calculator is straightforward:

- Enter the loan amount you plan to borrow.

- Input the interest rate offered by the lender.

- Select the loan tenure in months.

- Click on Calculate EMI to obtain the monthly installment details.

- Analyze the results to understand your repayment obligation.

Example Calculation

For instance, if a borrower takes a PKR 2,000,000 car loan at an interest rate of 10% per annum for 5 years (60 months), the monthly EMI would be approximately PKR 42,494.

Understanding this breakdown helps in comparing loan offers from different lenders and making an informed decision.

Factors Affecting Car Loan EMI

Several variables influence the EMI of a car loan, and understanding these factors can help borrowers manage their finances effectively.

1. Loan Amount

- A higher loan amount leads to a higher EMI.

- Opting for a lower loan amount reduces the monthly repayment burden.

2. Interest Rate

- Higher interest rates result in higher EMIs.

- Comparing multiple lenders can help secure a lower interest rate.

3. Loan Tenure

- A longer tenure decreases the EMI but increases the total interest paid.

- A shorter tenure increases the EMI but reduces overall interest expenses.

4. Down Payment

- A larger down payment lowers the loan amount and consequently the EMI.

- Most lenders require a down payment ranging from 10% to 20% of the car’s price.

Ways to Reduce Car Loan EMI

- Compare Interest Rates – Use online comparison tools to find the best rate.

- Opt for a Longer Loan Tenure – This reduces EMI but increases interest costs.

- Make a Higher Down Payment – This decreases the loan amount and EMI.

- Look for Prepayment Options – Some lenders allow early repayment to reduce the total interest paid.

- Negotiate Loan Terms – A good credit score can help in securing better rates and loan terms.

Best Banks for Car Loans in Pakistan

Several banks in Pakistan offer car loan facilities with competitive interest rates. Some of the most popular options include:

- HBL Car Loan – Offers flexible repayment options and competitive interest rates.

- Meezan Bank Car Ijarah – Provides Islamic financing for car purchases.

- Bank Alfalah Auto Loan – Features quick processing and low fees.

- UBL Auto Loan – Offers higher loan amounts with extended repayment periods.

- MCB Car Loan – Provides attractive interest rates and simple documentation.

Common Mistakes to Avoid When Applying for a Car Loan

- Not Checking the Interest Rate – Higher rates lead to increased EMIs.

- Ignoring Hidden Charges – Always review processing fees, late payment penalties, and other charges.

- Choosing a Very Long Tenure – This increases the total interest paid over time.

- Not Comparing Loan Offers – Failing to explore different lenders can result in higher costs.

- Overestimating Repayment Capacity – Ensure EMIs fit comfortably within the monthly budget.

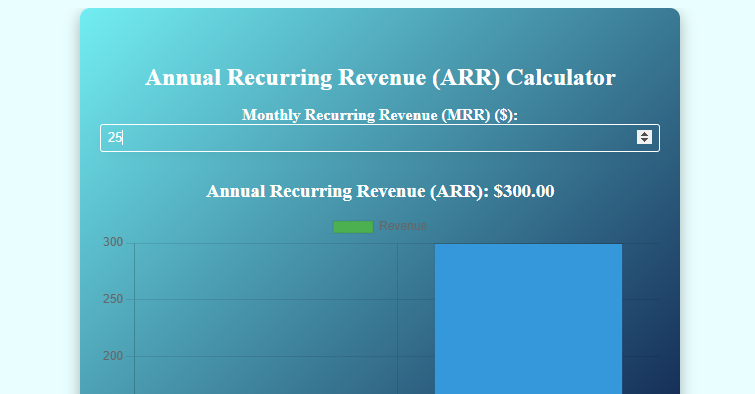

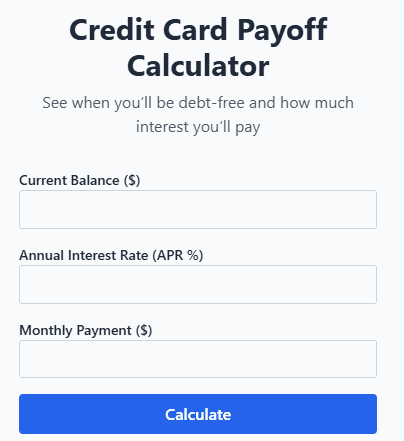

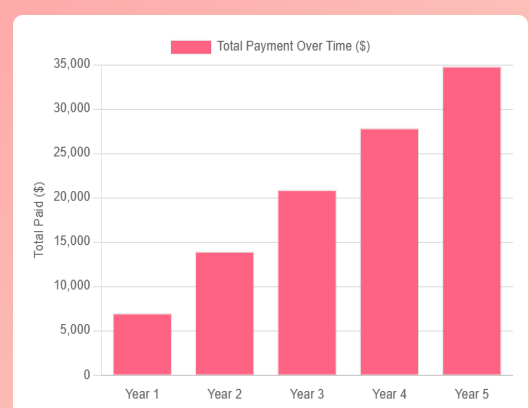

More Financial Tools on SharksTankPakistan.pk

A car loan is just one aspect of financial planning. To ensure better financial management, users can explore other financial tools available on SharksTankPakistan.pk:

- Net Worth Calculator – Helps in assessing overall financial health.

- Break-Even Calculator – Useful for business owners analyzing profitability.

- Compound Interest Calculator – Ideal for evaluating investment growth over time.

- Debt-to-Income Ratio Calculator – Helps determine the affordability of new loans.

- Profit Margin Calculator – Beneficial for entrepreneurs calculating business profitability.

By utilizing these tools, users can make well-informed financial decisions beyond car loans.

Frequently Asked Questions (FAQs)

1. Can I use the Car Loan EMI Calculator for used cars?

Yes, the calculator works for both new and used car loans.

2. Do banks offer 100% car loan financing?

Some banks offer full financing, but most require a down payment.

3. How does prepayment impact EMI?

Prepaying reduces the outstanding principal, lowering interest costs and EMI.

4. Can I get a car loan with a low credit score?

Yes, but lenders may charge a higher interest rate or impose stricter conditions.

5. Is car loan EMI tax-deductible?

Car loan EMIs are generally not tax-deductible in Pakistan.

Conclusion

A Car Loan EMI Calculator is a crucial tool for estimating monthly loan payments and making informed financial decisions. By understanding EMI calculations, comparing loan offers, and using additional financial tools available on SharksTankPakistan.pk, borrowers can secure the best possible financing options for their car purchase. Planning finances wisely ensures that the loan remains manageable and does not become a financial burden in the long run.

Explore the Car Loan EMI Calculator along with other financial tools on SharksTankPakistan.pk to make smarter financial decisions.

Car Loan EMI Calculator

Results

Estimated Monthly EMI: $0

Car Loan EMI Calculator

Results

Estimated Monthly EMI: $0