Debt-to-Income Ratio Calculator

Results

Debt-to-Income Ratio: 0%

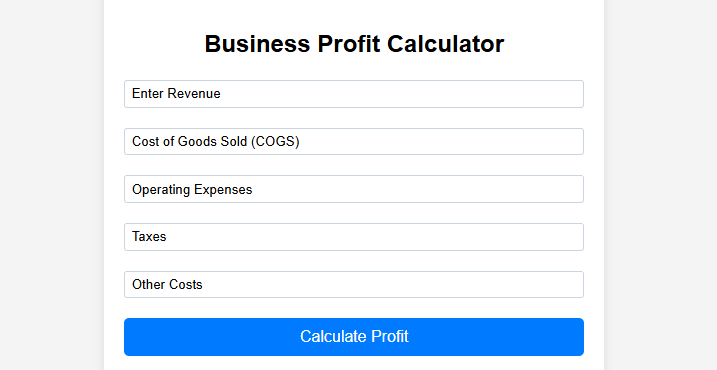

Managing your finances effectively starts with understanding your Debt-to-Income (DTI) ratio—a crucial metric that measures your financial health. The Debt-to-Income Ratio Calculator helps you determine how much of your monthly income goes toward paying debts, offering a clear picture of your borrowing capacity.

Whether you’re applying for a loan, planning your budget, or improving your financial stability, this tool provides quick and accurate insights to guide your decisions. Use it alongside other financial calculators on Sharkstankpakistan.pk to take control of your money.

What is the Debt-to-Income (DTI) Ratio?

The Debt-to-Income (DTI) ratio is a financial metric that measures the percentage of your monthly income that goes toward paying debts. Lenders use this ratio to assess your ability to manage monthly payments and repay borrowed money. A lower DTI ratio signifies better financial health, making it easier to qualify for loans and mortgages.

Why is the DTI Ratio Important?

Your DTI ratio plays a critical role in your financial well-being because:

- It determines loan eligibility for mortgages, personal loans, and business financing.

- A lower ratio improves your creditworthiness, increasing your chances of approval for loans with better interest rates.

- It helps you analyze financial stability and avoid excessive debt.

How is the Debt-to-Income Ratio Calculated?

The formula for calculating the DTI ratio is:

DTI Ratio (%) = (Total Monthly Debt Payments / Gross Monthly Income) × 100

Example Calculation:

Suppose you have the following monthly expenses:

- Mortgage: $1,500

- Car Loan: $400

- Credit Card Payments: $300

- Student Loan: $300

Total Debt Payments = $2,500 If your gross monthly income is $7,000, then:

DTI Ratio = ($2,500 / $7,000) × 100 = 35.7%

This means that 35.7% of your income is spent on debt repayments.

Understanding Your DTI Ratio: What’s a Good Percentage?

Lenders categorize DTI ratios into different risk levels:

| DTI Ratio | Financial Health | Loan Approval Chances |

|---|---|---|

| Below 20% | Excellent | Very High |

| 20% – 35% | Good | High |

| 36% – 43% | Moderate | Possible Approval (Depends on Lender) |

| 44% – 50% | Risky | Low Approval Chances |

| Above 50% | Critical | Very Low Approval Chances |

A DTI ratio below 36% is considered healthy, while anything above 43% may signal financial stress and make it harder to secure loans.

How to Reduce Your DTI Ratio?

If your DTI ratio is too high, consider these strategies to improve it:

1. Increase Your Income

Boosting your monthly earnings lowers your DTI ratio. Consider:

- Negotiating a salary raise.

- Starting a side business or freelancing.

- Investing in passive income sources.

2. Pay Off Debt Strategically

Reducing your debt load lowers your DTI ratio. Effective methods include:

- Debt Snowball Method: Pay off small debts first, then roll the payments into larger debts.

- Debt Avalanche Method: Pay off high-interest debts first to minimize total interest paid.

3. Refinance Loans

Refinancing loans to lower interest rates can help reduce monthly payments. Consider using Loan EMI Calculators to analyze the best refinancing options.

4. Limit New Debt

Avoid taking on new credit until your DTI ratio improves. This means:

- Not applying for new credit cards.

- Postponing large purchases that require financing.

5. Make Extra Payments

Paying more than the minimum required payments on loans can significantly reduce your outstanding debt faster.

How Lenders Use the DTI Ratio

Lenders rely on your DTI ratio to assess loan eligibility. Here’s how it impacts different types of loans:

1. Mortgage Loans

- Most lenders require a DTI below 43%.

- A lower DTI can qualify you for better mortgage rates.

- Use the Home Loan EMI Calculator to estimate monthly mortgage payments.

2. Personal & Auto Loans

- DTI below 36% is ideal for getting personal and car loans.

- The Car Loan EMI Calculator helps determine affordable car loan payments.

3. Business Loans

- Banks and investors prefer businesses with a healthy DTI ratio.

- Try the Business Loan EMI Calculator for business financing insights.

4. Credit Cards & Other Debts

- A high DTI ratio may lead to higher interest rates on credit cards.

- Consider using a Debt-to-Income Ratio Calculator to assess your financial situation.

Related Financial Calculators

For a complete financial analysis, combine your DTI ratio with other financial metrics using:

- Net Worth Calculator – To track overall wealth.

- Profit Margin Calculator – If you’re a business owner managing revenue.

- ROI Calculator – To evaluate return on investments.

Common Questions About the DTI Ratio

1. What is a Good DTI Ratio for Buying a Home?

Most mortgage lenders prefer a DTI ratio below 36%, but some may accept up to 43% for FHA loans.

2. Can I Get a Loan with a High DTI Ratio?

It’s possible, but it may come with higher interest rates and stricter terms.

3. Does My DTI Ratio Affect My Credit Score?

No, your DTI ratio itself doesn’t impact your credit score, but a high debt load can indirectly affect it by increasing credit utilization.

4. How Can I Check My DTI Ratio?

Use our Debt-to-Income Ratio Calculator for an instant calculation!

Conclusion

Understanding and managing your Debt-to-Income Ratio (DTI) is crucial for financial success. Whether you’re applying for a mortgage, personal loan, or business financing, maintaining a healthy DTI ratio improves your financial stability and borrowing power.

🔹 Start improving your financial health today! Use our Free Debt-to-Income Ratio Calculator and explore other financial tools on Sharkstankpakistan.pk for smarter money management.

Debt-to-Income Ratio Calculator

Results

Debt-to-Income Ratio: 0%