Opportunity Cost Calculator

Discover what your money could be worth if invested instead

Opportunity Cost Results

What is Opportunity Cost and Why It Matters to You

Imagine you’re standing at a crossroads with PKR 10,000 in your pocket. You could invest it in a savings account offering a modest 3% annual return, or you could put it into stocks that might yield 7%. If you choose the savings account, the 4% difference in potential earnings from the stocks is your opportunity cost—the value of the next best alternative you give up. This concept isn’t just a financial buzzword; it’s a powerful tool that can transform the way you manage your money.

Opportunity cost plays a pivotal role in personal finance, business decisions, and even everyday life choices. Whether you’re deciding between buying a new gadget or saving for a vacation, understanding what you’re sacrificing helps you make informed decisions. In 2025, with rising inflation and fluctuating markets, this knowledge is more valuable than ever. That’s where our Opportunity Cost Calculator comes in—a free, user-friendly tool designed to break down complex financial trade-offs into simple, actionable insights.

In this comprehensive guide, we’ll dive deep into what opportunity cost means, how to calculate it, and why our calculator is a must-have for anyone looking to optimize their finances. We’ll also include real-life examples, tables for clarity, and tips to embed this tool on your WordPress site for maximum benefit. Let’s get started!

Understanding Opportunity Cost: A Humanized Approach

At its core, opportunity cost is about trade-offs. Every time you spend money or time on one thing, you’re saying “no” to something else. For instance, if you spend PKR 5,000 on a weekend getaway, you might miss out on investing that amount in a fund that could grow over time. The catch? These decisions aren’t always obvious without a clear calculation.

What makes opportunity cost tricky is the hidden factors—like taxes, inflation, and the time value of money. Inflation erodes your purchasing power, while taxes reduce your net gains. Our calculator accounts for these variables, giving you a realistic picture of what your choices truly cost. Whether you’re a student saving for tuition, a parent planning for your child’s future, or a retiree managing your nest egg, this tool is tailored to your needs.

Why Opportunity Cost Matters in 2025

As of May 2025, global economic conditions are shifting. Interest rates are fluctuating, inflation is hovering around 2.5% in many regions, and tax policies are evolving. These factors make it harder to predict the real value of your money over time. By using an opportunity cost calculator, you can:

- Compare investment options with confidence.

- Adjust for inflation to see the true return.

- Factor in taxes to avoid surprises.

This tool empowers you to take control, especially when financial literacy is key to navigating today’s challenges.

How to Use the Opportunity Cost Calculator: Step-by-Step

Our Opportunity Cost Calculator is designed with you in mind—simple, intuitive, and packed with features. Here’s how to use it:

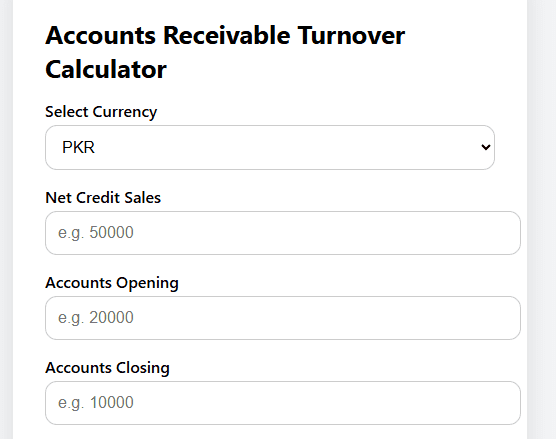

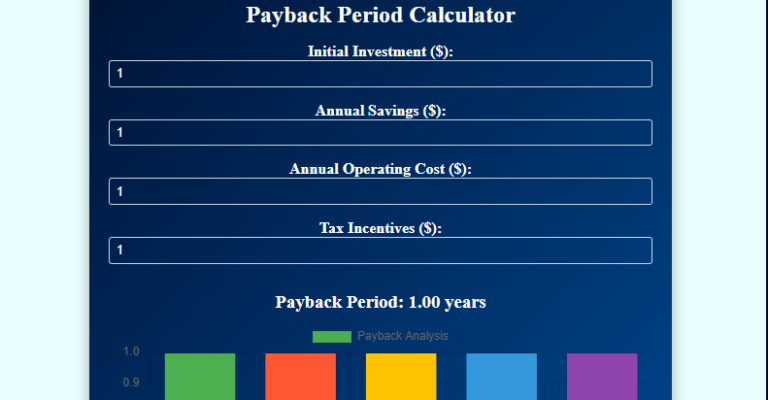

- Input Your Data: Start by entering the amount of money you plan to spend or invest (in PKR). Then, add the annual return on savings (e.g., 3%), the investment period (in years or months), the income tax rate (e.g., 12%), and the annual inflation rate (e.g., 2.5%).

- Get Instant Results: The calculator instantly shows your total savings after tax and the inflation-adjusted opportunity cost.

- Make Informed Choices: Use these insights to decide whether to invest, save, or spend elsewhere.

To give you a hands-on feel, try the calculator below with sample values. Adjust the numbers to match your scenario and watch the results update in real-time!

Sample Inputs and Outputs

Let’s walk through an example to make it relatable. Suppose you have PKR 10,000 to invest:

- Money to Spend: PKR 10,000

- Annual Return on Savings: 3%

- Investment Period: 2 years

- Income Tax: 12%

- Annual Inflation Rate: 2.5%

After running these through the calculator, you might see:

- Total Savings (After Tax): PKR 10,588

- Opportunity Cost (Inflation-Adjusted): PKR 10,231

This means your investment grows to PKR 10,588, but after adjusting for inflation, the real value is closer to PKR 10,231—highlighting the hidden cost of inflation.

Benefits of Using an Opportunity Cost Calculator

Why should you bother with this tool? Here are the tangible benefits that cater to your financial goals:

- Better Investment Decisions: Compare a high-risk stock with a low-risk bond and see which offers the best net gain.

- Inflation Adjustment: Understand how inflation eats into your returns over time.

- Tax Consideration: Get a clear picture after accounting for taxes, avoiding over-optimistic projections.

- Time-Saving: No need for spreadsheets or manual calculations—get results in seconds.

- Educational Value: Learn about finance in a practical way, making it ideal for beginners.

This calculator isn’t just for finance experts. It’s for anyone who wants to stretch their PKR and other currencies further, whether you’re saving for a house, planning a business, or building an emergency fund.

Detailed Guide to Calculating Opportunity Cost

Let’s break it down step-by-step so you can apply this concept even without the calculator.

Step 1: Determine Your Investment

Start with the amount you’re willing to allocate. For example, PKR 5,000 from your monthly salary.

Step 2: Evaluate Alternatives

List the options. Option A might be a savings account with a 2% return, while Option B could be a mutual fund with a 5% return.

Step 3: Input Values into the Calculator

Use the tool to enter:

- Initial investment (PKR 5,000)

- Return rates (2% vs. 5%)

- Period (1 year)

- Tax rate (10%)

- Inflation rate (2%)

Step 4: Analyze Results

The calculator might show:

- Savings Account (After Tax): PKR 5,090

- Mutual Fund (After Tax): PKR 5,225

- Opportunity Cost: PKR 135 (the value lost by choosing the savings account)

This process helps you see the bigger picture and adjust your strategy accordingly.

Real-Life Examples of Opportunity Cost

To make this relatable, here are scenarios you might encounter:

- Buying vs. Investing: You spend PKR 20,000 on a new phone. If invested at 4% annually for 2 years with 10% tax and 2% inflation, you might miss out on PKR 1,600 in growth.

- Education vs. Work: Skipping a year of work to study costs you a salary (e.g., PKR 300,000), but the degree might boost your earning potential by PKR 500,000 long-term.

- Spending vs. Saving: Choosing a PKR 15,000 vacation over a retirement fund could mean losing PKR 18,000 in 5 years at 3% return.

Tables for Clarity

Table 1: Sample Opportunity Cost Calculations

| Investment (PKR) | Return (%) | Period (Years) | Tax (%) | Inflation (%) | Total Savings (PKR) | Opportunity Cost (PKR) |

|---|---|---|---|---|---|---|

| 10,000 | 3 | 2 | 12 | 2.5 | 10,588 | 357 |

| 5,000 | 4 | 1 | 10 | 2 | 5,225 | 135 |

| 20,000 | 2 | 3 | 15 | 3 | 20,900 | 1,200 |

Table 2: Impact of Inflation on Returns

| Initial Investment (PKR) | Return Before Inflation (PKR) | Inflation Rate (%) | Real Return (PKR) |

|---|---|---|---|

| 10,000 | 10,600 | 2.5 | 10,340 |

| 5,000 | 5,200 | 3 | 5,050 |

| 20,000 | 21,200 | 2 | 20,760 |

Advanced Features of the Calculator

Our tool goes beyond basic calculations. Here’s what sets it apart:

- Flexible Units: Input periods in years or months to match your planning horizon.

- Real-Time Updates: Change any value, and the results adjust instantly.

- Supplementary Metrics: Optionally view detailed breakdowns (e.g., pre-tax returns, inflation impact).

- Shareable Results: Easily share your calculations with friends or advisors.

These features make it a dynamic tool for both personal use and professional advice.

Tips to Maximize Your Financial Decisions

- Review Regularly: Re-run the calculator quarterly to adjust for changing rates.

- Diversify: Use it to compare multiple investment options (e.g., stocks, bonds, real estate).

- Consult Experts: Share results with a financial advisor for tailored advice.

- Stay Informed: Keep up with 2025 economic trends to refine your inputs.

Common Questions About Opportunity Cost

What is a Good Opportunity Cost?

A “good” opportunity cost depends on your goals. If the alternative you give up yields a higher return after adjustments, it’s worth reconsidering your choice.

How Often Should I Calculate Opportunity Cost?

Recalculate whenever you face a major financial decision or when market conditions change (e.g., interest rate hikes).

Can This Tool Predict the Future?

No tool can predict exact outcomes, but it helps estimate based on current data, giving you a solid foundation.

Start Calculating Today!

Are you ready to take charge of your financial future and make informed decisions that align with your goals? Our Opportunity Cost Calculator is a free, user-friendly tool designed to empower you every step of the way. Whether you’re diligently saving for a dream home, meticulously planning for a comfortable retirement, or simply curious about unlocking the hidden potential of your money, this calculator serves as your trusted guide.

With just a few clicks, you can input your financial details—such as investment amounts, expected returns, taxes, and inflation rates—and watch as it reveals the true impact of your choices. Try it now and experiment with different scenarios to see how small adjustments can lead to significant outcomes. Share your insights with family, friends, or financial advisors to spark meaningful conversations, and together, let’s make 2025 your year of financial clarity and confidence. This tool is more than just a calculator—it’s a pathway to mastering your money and building a brighter future!