Company Valuation Calculator

Estimate your company’s worth using multiple valuation methods and currencies

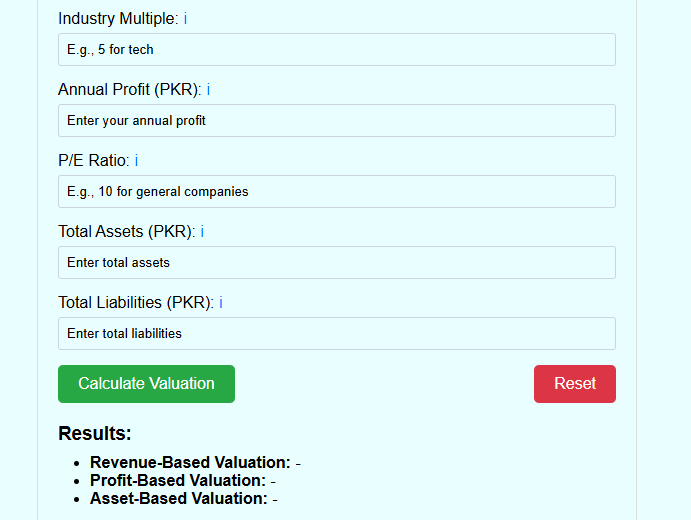

- Revenue-Based Valuation(Revenue × Industry Multiple)PKR 0

- Profit-Based Valuation(Profit × P/E Ratio)N/A

- Asset-Based Valuation(Assets – Liabilities)N/A

- Weighted Average Valuation(Combined valuation estimate)PKR 0

Industry Revenue Multiples Reference

| Industry | Typical Multiple Range | Notes |

|---|---|---|

| Technology/SaaS | 5-10x | Higher for fast-growing companies |

| Healthcare | 3-6x | Varies by specialty |

| Retail | 0.5-2x | Lower for brick-and-mortar |

| Manufacturing | 1-3x | Depends on margins |

| Restaurants | 0.5-1.5x | Location-dependent |

| Professional Services | 1-3x | Higher for recurring revenue |

A valuation calculator helps you estimate the worth of an asset, business, or investment based on specific financial metrics and data inputs. This tool provides a snapshot of value. Learn how to leverage it to capitalize on your community’s strengths and wealth when you’re pursuing economic development, affordable housing, or smart growth initiatives.

These business valuation calculators take into account important valuation factors such as revenues, expenses, market conditions, and industry averages. They provide the most fruitful and true-to-life fixes for your enterprise. You can turn to them to simplify multifaceted calculations, allowing you to save time while eliminating your margin for error.

These tools are not only more intuitive, they’re more user-friendly. They’re targeted to practitioners and laypeople alike, with no advance degree in finance needed.

In the sections ahead, we’ll explore how valuation calculators work, their benefits, and tips for using them effectively in your financial planning.

What is a Valuation Calculator?

A valuation calculator is a practical tool. This free and simple tool will give you a quick estimate of what your business is worth based on key financial and operational drivers.

Second, it clarifies esoteric valuation approaches. It accomplishes this lofty goal by applying uniform formulas to all projects. Most importantly, it hones in on a few critical data points such as revenue, EBITDA, and growth rate.

We believe this new tool will be a great resource to help business owners, investors, and their financial advisors gauge the value of these opportunities. Use it to allow you to safely and confidently chart your course down the road to a merger, acquisition, fundraising or exit.

Define Business Valuation

Simply put, business valuation is the process of determining a business’s economic value. This valuation considers risks like expected business economics, market conditions, and prospects for long-term growth.

Put simply, revenue trends and today’s market conditions have a major impact on valuation results. Accurate valuation is critical to realizing long-term strategic goals.

This powerful understanding begins to allow stakeholders to understand a business’s competitive advantage in their market area. It identifies areas for expansion, innovation and improvement.

Purpose of Valuation Calculators

The overarching intent behind creating these valuation calculators is to increase accessibility, understanding and efficiency of valuation processes. Investing the time to deliver quick estimates goes a long way.

It provides an interactive platform for entrepreneurs and investors to quickly compare several valuation methods and business possibilities side-by-side. These tools enable simulating varying amounts of investments and corresponding resulting equity stakes.

This exposes them to significant uncertainty that can easily distort the company’s pre-money and post-money valuation. This provides both investors and companies with transparency all along the investment pipeline.

Benefits of Using Calculators

Standardized formulas using multi-directional mathematics offer significant time savings and accuracy of the resulting output. Valuation calculators lead to more accurate valuations more quickly.

These tools are especially important to the many small business owners that do not have a strong financial education. They are user-friendly and data-poor, needing limited data input, usually just a revenue and/or operating expense number.

Their simplicity of use only adds to their dangerously misplaced power when it comes to estimating and communicating business value.

Types of Valuation Calculators

Valuation calculators are great, informative tools that are widely used to determine the fair market value of a business or asset. Each has its advantages and disadvantages which can heavily depend on your business lifecycle stage, industry, or end-use case. They provide customized analysis that meets unique needs.

Below, we’ll explain their types, uses within startups, operating companies, real estate, and other assets.

Startup Valuation Calculators

For startup companies, future growth potential and projections are heavily weighted into these valuation calculators. These tools tend to have more sophisticated metrics such as user acquisition costs, customer lifetime value, and projected market share.

Our startup valuation calculator estimates the worth of your company according to your current annual revenue growth rate. It uses various industry multipliers, including 3x for tech companies, to arrive at the final valuation.

This approach is critical to attract investor capital, as it demonstrates potential to be scaled and to scale profitably. These calculators lean pretty far into the intangible soft factor bacon.

Intellectual property and state-of-the-art technology are the grist of the mill of new, high-growth firms.

Established Business Calculators

When it comes to more mature companies, valuation calculators take a deeper dive into existing operations and past performance. Revenue and EBITDA multiples are useful guides that get you to fair market value.

These metrics are only the beginning for a thorough, complete evaluation. The times-revenue method, for example, simply takes a multiple of annual revenue—like 0.5x for service-based firms or 3x for tech firms.

These calculators assist business owners in evaluating their business’s value for sale, partnership, or succession planning.

Real Estate Valuation Calculators

Real estate valuation calculators determine real estate values based on the most important factors. They consider things like location, current market trends, and the general condition of the property.

Such a calculator to create, for example, would compare other like property sales within the same zip code to establish fair market value. Real estate investors, sellers, and agents have recently been leaning heavily on these tools.

They rely on them to price properties competitively and to find the most profitable investments.

Asset Valuation Calculators

These small business-friendly calculators work to help businesses value tangible assets, such as equipment and facilities, and intangible assets such as trademarks. They are central to mergers and acquisitions, where the billions in commonly contested valuations can often make or break negotiations and deals.

These calculators give businesses net realizable value for liquidation scenarios, which can help them evaluate financial risks and opportunities.

How a Valuation Calculator Works

Business valuation calculators are simple but powerful tools that help businesses determine how much their business is worth. It starts with known inputs and applies simple, financially sound formulas that are accepted by the finance and investment community.

Her ROI methodology is like a fast pass that makes the usually painful valuation process much more straightforward. Tens of thousands of numbers that would otherwise require manual processing, it’s all automatic now.

This allows it to identify key determinants such as EBITDA, CAGR, industry multiples and discount rate. We input these inputs and compute the discounted value of future cash flows or earnings. This initial step takes into account factors such as risk and opportunity for growth.

The bigger the discount rate, let’s say 10%, the bigger the no marketability. Thus, a lower or even negative interest rate starts looking more appealing in the financial market.

Special business features, such as a valuable trademark, often enter into the equation, affecting how courts arrive at that final value calculation.

Underlying Financial Models

Valuation calculators are arguably most dependent on financial models. One common approach they all take is the discounted cash flow (DCF) method, which estimates future cash flows and future profits.

DCF approach values potential earnings by calculating the present value of future cash inflows. As a result, it is very important to assume the right things. If growth rates are inflated, the valuation is artificially inflated.

Conservative numbers result in a more trustworthy valuation. These return on investment models allow users to evaluate the potential of the business. Yet, they offer a better and more honest picture of its financial health.

Data Sources Used

Critical data sources are frequently the financials – income and cash flow statements – and industry or market reports. When utilized alongside a well-founded set of data, the calculator comes up with accurate and robust results.

Measuring against available industry benchmarks gives you a healthy context in which to make comparisons. Having several sales to compare against gives you a critical context for measuring a business’s performance against its closest rivals.

This understanding further improves the depth and precision of the valuation.

Algorithm Overview

Algorithms take inputs to run through different formulas, DCF being one of the most common, to output valuations. Further, as their accuracy has a clear effect on reliability, user-defined parameters allow flexibility for customizing the tool to suit specific needs.

Adjusting certain factors, like growth assumptions or risk adjustments, personalizes the calculation to your specific business needs.

Key Inputs for Valuation Calculators

Knowing and understanding the inputs needed for a valuation calculator is critical for receiving accurate and reliable business valuation estimates. By combining quantitative data with market insights, these tools provide a clear picture of a company’s worth, which helps stakeholders make informed decisions.

Financial Statement Data

In our experience, sound and complete financial statements form the foundation of any successful valuation procedure. Key financial documents, such as income statements and balance sheets, are especially important. Together, these two have the most complete picture of a company’s profitability, cash flow, assets, and liabilities.

EBITDA, or earnings before interest, taxes, depreciation, and amortization, is usually the starting input. As a valuation tool, it provides a misleading perspective of their profitability, beyond a company’s core operational profitability. Trends for past performance are very critical to valuation projections.

Sustainable revenue growth with variable investor profitability are important high-level inputs to value that should be explored. Financial health indicators like debt-to-equity ratios and liquidity ratios demonstrate the company’s fiscal soundness. In the short run, though, they point to 20+ years of promise that it can continue growing far past the initial boom.

Market Data and Comparables

Market data helps speed up the valuation process by bringing comparables that conform to widely accepted best practices and norms into sharper focus. Maybe most importantly, the comparable company analysis is best known and most powerful, as it uses other peer companies to determine valuation yardsticks.

For instance, if a peer with similar expected earnings growth is trading at a given multiple, that can be used to guide your valuation. Today’s market conditions, like the growth rates of industries or economic conditions, are used to further sharpen these calculations. This makes sure the valuation accurately represents what’s happening today.

Qualitative Business Factors

Qualitative factors like management’s track record, strength and perception of brand, and customer loyalty come into valuation. For instance, the management team often is a reflection of leadership and operational strength.

These factors, in addition to macroeconomic forces and competitive positioning, provide a complete picture of an enterprise’s true, intrinsic value.

How to Use a Valuation Calculator

Here’s how you can use an online valuation calculator to find out what a business is worth. It achieves this by analyzing the financial side and the operational side simultaneously. Stakeholders can take part in a more robust process to achieve outcomes that are defendable and far-reaching.

Change our recommended inputs to fit your specific business landscape. Here’s everything you need to know in a short, but thorough crash course on strategically leveraging this first-of-its-kind tool.

1. Select the Right Calculator

More specialized calculators are meant for certain industries, ages of business or types of valuation (asset-based, market-based, income-oriented, etc.) A new startup would be better served with a calculator that allows you to focus in on future expected cash flows.

A larger, more established company may need one that demonstrates an emphasis on EBITDA. Review their unique offerings and technical approaches, and select the organization whose mission and approach aligns most closely with your goals.

Not every calculator allows you to enter in a growth rate, but many do. This closing attribution is particularly crucial for small and mid-sized businesses that are seeking to operate and flourish in competitive, specialized markets.

2. Gather Necessary Financial Data

In order to achieve the most fruitful results from the calculator, you should arrive with the most complete and accurate information available. Key numbers include most recent TTM sales and profit, owner’s salary and last year’s annual EBITDA.

It’s no surprise then that this information forms the basis of the valuation. Even a minor error could have catastrophic consequences. Gather all known information pertaining to the subject entity, estimating revenues and future cash flow projections.

For longer-term impact, commend more deeply and meaningfully by zooming in on a particular, very brief period of time. Try to target a term of no more than 10 years.

3. Input Data Accurately

Time your inputs carefully to receive optimal outputs. You’re able to set default growth rates to whatever you’d like, ranging from 0% to 100%. On the left-hand side, you can adjust cash flow lengths from 0-10 years.

Seemingly small boondoggles can blow devastating holes into our bottom line. If every year they misreport revenue or risk level, valuation becomes worthless. The more precise you are with your input, the better the calculator can help you understand what your business is really worth.

Improve Valuation Accuracy

As you can see, accurate valuations of your business largely depend on effective strategy, up-to-date market intelligence, and a realistic projection of future performance. By refining these elements, you can better understand your business’s true worth, whether for growth planning, investment, or eventual sale.

Integrate Market Data

We’ll walk you through why leveraging today’s market data is essential for effective appraisals to help you get started. Shifts in consumer demand and moves made by your competition directly impact what your business is worth. Keep your eyes on these market indicators for real-time perspective!

In an equally booming industry, a high-tech startup can sit on a rich valuation. When the industry experiences a cyclical downturn, that valuation can plummet. Keep these topics on your radar. This way, you can be sure that your valuation closely mirrors what’s being seen in today’s market.

Resources like the BizEquity report are a great jumping off point. To avoid putting your valuable assets at too great a risk, first do a comprehensive market analysis. Engaging an accredited appraiser with ASA or CVA credentials will result in a more defensible valuation.

Ongoing adjustments, matched with actual market knowledge, balance upswings and downturns, offering a more accurate outlook over time.

Refine Financial Projections

The third step is to establish, and regularly revise, financial projections. Projections rooted in achievable goals reduce valuation errors a product of overzealous enthusiasm or the application of obsolete criteria.

Improving a used manufacturing company’s forecast can produce better results by tightening the range. By integrating recent economic indicators, including national inflation rates and supply chain costs, we can adjust cash flow estimates to better reflect current conditions.

Valuation techniques like discounted cash flow (DCF) are deeply anchored in accurate predictions. Keeping those going and returning to them is an investment that leads to the clearest, most accurate valuation – and ultimately most valuable valuation.

Sensitivity Analysis

A sensitivity analysis is standard practice in the valuation field. It tests how sensitive the overall valuation is to changes in key inputs, such as revenue growth rates or discount rates. Understanding these disparities equips you to take the initiative in addressing risks that threaten to reduce your business’s value by 20%—30%.

That might mean a $20 million valuation value crashing down to $15.3 million. This is easily possible when severely understate risk factors like loss of market share.

This approach provides an opportunity to make proactive adjustments that can help prevent undervaluation.

Common Pitfalls to Avoid

General valuation calculators, like our business valuation calculator, are great resources for getting educated and informing your business valuation. When they’re misused, you may be setting yourself up for very expensive errors.

Avoiding these four common pitfalls will greatly increase your chances of success in arriving at the most accurate possible valuation.

Inaccurate Data Input

Human error in data input poses a huge danger to potential valuation success. Financial projections, including revenue projections, operating expenses, and expected growth rate, must be perfectly aligned.

A small error can completely change the resulting calculated value. For example, it’s surprisingly easy to get discounted cash flow valuations seriously wrong. This occurs when the discount rate appropriate for one stream of income is applied to a different one.

If you don’t take the built-in gains tax on appreciated S corporation assets into account within the five-year lookback period, you overestimate. Here’s how to never fall prey to this deadly beginner mistake.

Conduct a high level financial statement line item review and thorough cross reference against off-balance sheet liabilities or non-operating assets. This detailed, labor-intensive process is mission critical to making sure that the data accurately represents what really matters to a business—its bottom line.

Over-Reliance on Default Assumptions

Keep in mind, default assumptions that calculators rely on are usually broad and won’t take into account your specific business situation. As a practical matter, default discount rates typically do not account for risks specific to a business.

These are known as discounts for lack of liquidity. Among them are discounts for lack of control (DLOC) and discounts for lack of marketability (DLOM). Thoughtful tuning of these parameters is essential to make sure that the valuation reflects real life intricacies.

Understanding the reason for defaults is a critical prerequisite step. The risk in taking them at face value is substantial. You’ll miss out on major factors, like built in capital gains taxes factored into purchase prices.

Ignoring Qualitative Factors

Quantitative data, even at such a granular scale, as important as it is, isn’t enough to tell the whole story. Ignoring qualitative factors—like the management’s quality, customer/supplier relationship, or competitive advantage and industry evolution—paints the wrong picture.

Too frequently, companies miss the non-financial impact of employee retention via attrition. This mistake can greatly diminish the total value of the company.

Navigating this intersection of quantitative and qualitative data results in a more equitable and participatory valuation process.

Valuation Calculator vs. Traditional Methods

We know that traditional valuation calculators have their own unique advantages. By understanding their differences, you’ll be better equipped to choose the one that serves your needs. User-friendly, quick, and easy, calculators are all about instant accessibility.

Relative to these, traditional approaches value the surface of analysis, providing us with a broader, deeper, more textured view far more often.

Cost and Time Efficiency

Valuation calculators help you save time, providing results in a matter of hours. Traditional valuations might take weeks. This fast production is particularly advantageous for small business owners who require immediate value estimates without interrupting their ongoing operational workflows.

Utilizing a business valuation calculator allows them to gauge their company’s worth swiftly, which is crucial for making informed financial decisions. Moreover, these calculators are much less cost prohibitive, often costing only $500, compared to certified valuations, which can start at $5,000 or higher.

Startups and small businesses appreciate the money valuation calculator as a useful tool for its value for the money. It gives them the opportunity to gain instant appraisal of their financial wellbeing.

Accuracy and Customization

Though calculators almost always give accurate outputs, they still fall short in accuracy compared to more rigorous approaches. With traditional valuation, we’re usually going to be taking a historical retrospective view at least three years of financials, tax returns, and other information.

This intensive methodology leads to a specific and sound valuation that truly fits the unique context of the property. These calculators are highly customizable. Changing key inputs such as revenue, operating expenses, and growth rates can provide much more accurate estimates.

For the smaller, less complex businesses, this degree of customization is usually sufficient. It’s an invaluable tool for its speed and accuracy. It really hits that sweet spot.

When to Use Each Method

Use a business valuation calculator to get first-cut, ballpark estimates that will get business owners ready to negotiate or gauge market demand. When it comes to high-stakes situations such as mergers or acquisitions, traditional ways take precedence.

It’s the right valuations and complex calculations that these professionals deliver that inform sound decisions.

Best Practices for Reliable Valuations

Getting a business valuation right isn’t luck. They deserve nothing less than a disciplined and rigorous process powered by a business valuation calculator, good, current data, economic context, and deep professional experience. By using these techniques, you can begin to ensure a better, more defensible valuation process.

Regularly Update Data

Having the most accurate, real-time financial data is essential. Back-of-the-envelope valuation calculators are only as good as their inputs, and all too often, the resulting outputs are poisoned by outdated or incomplete information. If your financials aren’t adjusted for lost or gained revenue from closing time or pandemic business changes, your company’s worth could be inaccurate.

That can lead to your company being overvalued, or worse, undervalued. Create, maintain, and frequently reassess your income statements, balance sheets, and cash flow statements. This simple practice will save everyone time and ensure that all dollar amounts remain consistent and accurate.

Businesses in high-growth sectors such as SaaS are highly insulated from this risk. When their source of predictable revenue diminishes, often their valuations are hit hard.

Understand Economic Indicators

Economic factors are key to determining the value of the business. An increase to interest rates, inflation, or even shifts in market trends can have drastic and immediate impacts on valuation results. During periods of economic prosperity, firms operating within the more stalwart yet consistent industries often have lower valuation volatility.

By comparison, tech startups usually jump much, much further, sometimes at 3 to 5x their earnings. Aligning valuations with these societal shifts is essential to remaining relevant. The Discounted Cash Flow (DCF) method, for instance, works well when future cash flow projections align with current market conditions.

Seek Professional Advice

Engaging regularly with financial experts deepens your knowledge. Yes, we all learn quickly. This is even more the case for larger and more complex enterprises. In addition, only knowledgeable professionals can properly validate calculator outputs, making sure they accurately account for real world conditions.

Independent third-party valuations provide credibility, which is especially helpful in negotiations of a sale. Experienced specialists can help you identify the best techniques for your unique circumstances. For enterprises with established histories of revenue generation, they usually recommend the GPC Method.

Their recommendations lay the groundwork for a more holistic valuation strategy.

Conclusion

A simple valuation calculator offers a quick, simple way to value just about anything. It increases productivity, lowers risk, and results in more effective nationwide transportation planning. Fed the right inputs, and with careful consideration of the outputs, you can trust tools like these to help you unlock powerful insights.

A Valuation Calculator is an indispensable tool for entrepreneurs, investors, and business owners looking to assess their company’s financial worth. Whether preparing for Shark Tank Pakistan, attracting investors, or planning an exit strategy, this tool offers a fast, reliable, and informed valuation estimate.

💡 Don’t guess your company’s worth—calculate it today! Try our Shark Tank Pakistan Valuation Calculator free and make data-driven financial decisions. 🚀

Company Valuation Calculator

Estimate your company’s worth using multiple valuation methods and currencies

- Revenue-Based Valuation(Revenue × Industry Multiple)PKR 0

- Profit-Based Valuation(Profit × P/E Ratio)N/A

- Asset-Based Valuation(Assets – Liabilities)N/A

- Weighted Average Valuation(Combined valuation estimate)PKR 0

Industry Revenue Multiples Reference

| Industry | Typical Multiple Range | Notes |

|---|---|---|

| Technology/SaaS | 5-10x | Higher for fast-growing companies |

| Healthcare | 3-6x | Varies by specialty |

| Retail | 0.5-2x | Lower for brick-and-mortar |

| Manufacturing | 1-3x | Depends on margins |

| Restaurants | 0.5-1.5x | Location-dependent |

| Professional Services | 1-3x | Higher for recurring revenue |

Frequently Asked Questions

What is a valuation calculator used for?

Our new valuation calculator provides quick and easy estimates of the value of small, public sector assets. It’s true for people but for businesses and investments! It streamlines what would otherwise be complex costing and financial modelling.

It’s earnestly the gold standard, and very often its literal application is in corporate, municipal, and investment decision making. This is heavily utilized in business, real estate, and investments.

What types of valuation calculators exist?

There are several types of valuation calculators, including the business valuation calculator, real estate valuation calculator, business stock valuation calculator, and discounted cash flow (DCF) calculator.

Each approach to valuation addresses different functions, irrespective of what the asset or investment is being valued.

What are the main inputs for a valuation calculator?

To calculate final valuations precisely, you’ll require several key inputs. These include your expected revenue, expense, growth rate, discount rate, and relevant market data.

All these elements are key to any online business valuation calculator generating a correct and precise valuation.

How does a valuation calculator improve accuracy?

Automated math and trusted financial formulas built into a business valuation calculator will save you (and your team) from human error.

By choosing the appropriate variables and equations to best suit your needs, this decision will produce impactful outcomes. It allows you to make the optimal investment decision.

Can I use a valuation calculator for any business?

This strategy is most effective for companies that have an easily identifiable financial yardstick. For instance, they might decide to play around with a business valuation calculator to determine their true value.

However, with startups or niche industries, additional subject matter expertise or iteration is required to arrive at a useful or pragmatic valuation.

How is a valuation calculator different from traditional methods?

Past approaches have focused largely on calculations and subjective evaluation. The calculators streamline the processes and make them quicker and more consistent.

What are common mistakes when using a valuation calculator?

Stay tuned for our future posts about other valuation calculator pitfalls! These errors range from using old or wrong data to disregarding market trends.

Additionally, over-relying on the tool and its output can lead to inaccuracies.

I’d like to remind you to double-check all inputs independently and consult with experts.