In the competitive world of business, understanding profit calculation is essential for long-term success. A Business Profit Calculator helps entrepreneurs, small business owners, and corporate executives accurately determine their financial gains. This tool simplifies complex calculations and provides insights into revenue, costs, and profitability.

In this comprehensive guide, we will explore how a Business Profit Calculator works, its importance, key components, and how businesses can leverage it to optimize profitability.

What is a Business Profit Calculator?

A Business Profit Calculator is an online or software-based tool designed to calculate a company’s net and gross profit based on various financial inputs. It allows businesses to measure profitability by considering revenue, expenses, taxes, and other financial factors.

Types of Business Profit Calculators

- Gross Profit Calculator – Computes gross profit by subtracting the cost of goods sold (COGS) from total revenue.

- Net Profit Calculator – Determines net profit after deducting operating expenses, taxes, and additional costs.

- Break-Even Calculator – Helps businesses determine the point at which total revenue equals total costs.

- ROI Calculator – Measures return on investment based on net profit and investment cost.

Why Use a Profit Calculator?

A Profit Calculator provides numerous advantages:

- Accuracy in Financial Analysis: Eliminates errors in manual calculations.

- Time-Saving: Quickly computes profits and losses.

- Informed Decision-Making: Helps in budgeting, pricing, and investment decisions.

- Better Financial Planning: Assists in forecasting future profits and sustainability.

- Tax Planning: Estimates tax liabilities based on business income.

Key Components of a Business Profit Calculator

1. Revenue

Revenue refers to the total income a business generates from sales before deducting any expenses.

2. Cost of Goods Sold (COGS)

COGS includes direct costs associated with producing or purchasing goods.

Formula: COGS = Beginning Inventory + Purchases – Ending Inventory

3. Gross Profit

Gross profit is the revenue remaining after deducting COGS.

Formula: Gross Profit = Total Revenue – COGS

4. Operating Expenses

Operating expenses include rent, utilities, salaries, marketing, and other costs necessary to run the business.

5. Net Profit

Net profit is the final profit after deducting all expenses, taxes, and other costs.

Formula: Net Profit = Gross Profit – Operating Expenses – Taxes

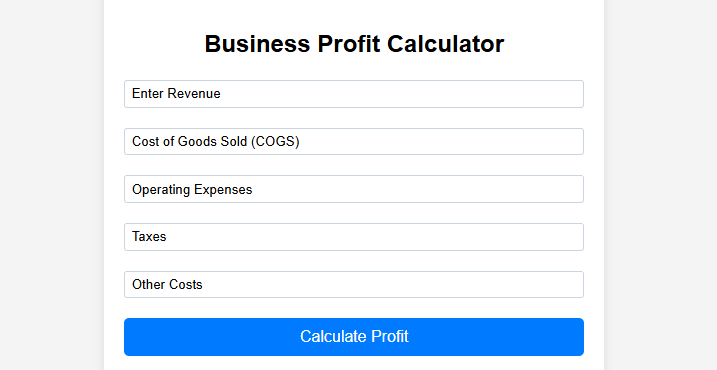

How to Use a Business Calculator?

Using a Business Profit Calculator involves the following steps:

- Enter Total Revenue – Input the total sales revenue.

- Enter COGS – Provide the cost of goods or services.

- Include Operating Expenses – Add rent, salaries, and other business costs.

- Account for Taxes – Input applicable tax percentages.

- Calculate Profit – The calculator will generate gross profit, net profit, and profit margins.

Profitability Metrics to Track

1. Gross Profit Margin

Gross Profit Margin measures the percentage of revenue that exceeds COGS.

Formula: Gross Profit Margin = (Gross Profit / Total Revenue) × 100

2. Net Profit Margin

Net Profit Margin represents the percentage of total revenue that remains after all expenses.

Formula: Net Profit Margin = (Net Profit / Total Revenue) × 100

3. Return on Investment (ROI)

ROI evaluates the profitability of an investment.

Formula: ROI = (Net Profit / Investment Cost) × 100

Best Business Profit Calculators Available Online

- QuickBooks Profit Calculator – Ideal for small businesses and freelancers.

- Shopify Profit Calculator – Useful for eCommerce stores.

- Shark Tank Pakistan Profit Calculator – A versatile tool for startups and businesses.

- Microsoft Excel Profit Templates – Customizable and flexible for financial planning.

- Investopedia Financial Calculators – Reliable and accurate for in-depth profit analysis.

Tips to Increase Business Profitability

1. Reduce Operational Costs

- Optimize supply chain management.

- Automate repetitive tasks.

- Negotiate better deals with suppliers.

2. Improve Pricing Strategy

- Use competitive pricing models.

- Implement value-based pricing.

- Offer bundle deals and discounts strategically.

3. Increase Sales Revenue

- Enhance digital marketing efforts.

- Expand product or service offerings.

- Improve customer retention strategies.

4. Monitor Financial Performance Regularly

- Use financial reporting tools.

- Conduct monthly profit and loss analysis.

- Adjust strategies based on real-time data.

Common Mistakes to Avoid in Profit Calculation

- Ignoring Hidden Costs – Always consider additional expenses like depreciation and interest.

- Overestimating Revenue – Be realistic with revenue projections.

- Underpricing Products – Ensure pricing covers all costs and yields profit.

- Not Updating Financial Records – Keep records accurate and up to date.

Final Thoughts

A Business Profit Calculator is an essential tool for businesses aiming for financial stability and growth. Whether you’re a startup owner, entrepreneur, or investor, understanding profit metrics and leveraging a reliable Business Profit Calculator can help optimize financial success.

By implementing the best financial strategies and regularly monitoring profitability, businesses can achieve sustainable growth and long-term success.

Use Our Free Business Profit Calculator!

To take control of your business finances, try Shark Tank Pakistan’s Free Business Profit Calculator. This easy-to-use tool helps you measure profitability accurately and make informed financial decisions. Calculate your business profits with a free Business Calculator below now!

Advanced Profit Analyzer

Calculate and visualize your business profitability with actionable insights

Profit Summary

Enter your financial data to see detailed analysis

Expense Breakdown

Profit Visualization

Profit Optimization Tips

Reduce COGS Cost of Goods Sold includes direct material and labor costs

Negotiate with suppliers for bulk discounts or explore alternative vendors for better pricing.

Optimize Operations

Streamline processes to reduce waste and improve efficiency in your production line.

Review Expenses

Audit recurring expenses and eliminate unnecessary subscriptions or services.

Tax Strategies

Consult with a tax professional about potential deductions and credits you may qualify for.

FAQs

1. What is the difference between gross profit and net profit?

Gross profit is revenue minus COGS, while net profit is the final profit after deducting all expenses, including taxes and operational costs.

2. How often should I use a Business Profit Calculator?

It is recommended to use a Business Profit Calculator monthly or quarterly to track financial performance effectively.

3. Can a Business Profit Calculator predict future profits?

While a Business Profit Calculator provides financial insights, forecasting requires additional tools like financial modeling and trend analysis.

4. Is a Business Profit Calculator suitable for startups?

Yes, startups can use a Business Profit Calculator to assess profitability, set financial goals, and make informed business decisions.

By utilizing a Business Profit Calculator, businesses can maximize their profitability and maintain a competitive edge in the market.