Understanding your break-even point is crucial for making informed business decisions. A Break-Even Calculator helps entrepreneurs and businesses determine the sales volume required to cover costs and start generating profits. Without a solid grasp of break-even analysis, businesses risk mispricing their products, overspending on expenses, or setting unrealistic revenue goals.

In this comprehensive guide, we’ll cover:

- What break-even analysis is and why it’s important

- The formula for break-even point and how to calculate it manually

- The benefits of using a Break-Even Calculator

- How to apply break-even analysis in real-world scenarios

- Common mistakes businesses make when calculating break-even points

- FAQs about break-even analysis

By the end, you’ll have a clear understanding of how to use break-even analysis to improve your financial strategy and business performance.

What Is Break-Even Analysis?

A break-even analysis helps businesses determine the sales volume required to cover their costs. The break-even point (BEP) is the level at which total revenue equals total costs—meaning no profit or loss. Reaching this point is a key milestone for businesses, as it signals financial stability and the potential for future profits.

Why Is Break-Even Analysis Important?

Break-even analysis is a fundamental concept in business finance. It helps businesses:

- Determine viability: Before launching a product or service, knowing the break-even point helps assess if the business idea is financially feasible.

- Set realistic sales goals: Business owners can establish clear revenue targets to ensure they reach profitability.

- Manage costs effectively: Identifying how much revenue is needed to cover costs enables businesses to optimize expenses.

- Improve pricing strategies: Break-even analysis helps determine the best pricing model to balance revenue and affordability.

- Attract investors: Investors and lenders want to know when a business is expected to become profitable, making break-even analysis a key financial tool.

Formula for Break-Even Point

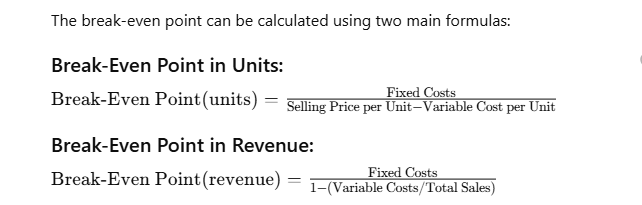

The break-even point can be calculated using two main formulas:

These formulas help businesses understand how many units they need to sell or the total revenue required to break even.

Example Calculation

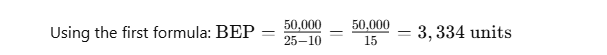

Let’s consider a business that has:

- Fixed Costs = $50,000

- Selling Price per Unit = $25

- Variable Cost per Unit = $10

This means the business needs to sell 3,334 units to break even. If the company sells fewer units, it will operate at a loss; selling more units will result in a profit.

How to Use a Break-Even Calculator

A Break-Even Calculator simplifies the process by automating calculations and providing instant results.

Steps to Use the Calculator

- Enter Fixed Costs – Include rent, salaries, utilities, and other fixed expenses.

- Enter Variable Costs per Unit – List materials, production costs, and other expenses that fluctuate with sales.

- Enter Selling Price per Unit – The amount charged per product or service.

- Click Calculate – The tool will determine the break-even point in units and revenue.

Benefits of an Online Calculator

- Saves time: No need for manual calculations.

- Reduces errors: Ensures accuracy by eliminating human mistakes.

- Customizable inputs: Allows adjustments for different business scenarios.

- Graphical insights: Some calculators provide charts showing break-even trends.

Common Mistakes in Break-Even Analysis

Many businesses make errors when calculating their break-even point, leading to inaccurate financial planning. Here are some common mistakes:

1. Ignoring Variable Costs

Some businesses underestimate the impact of variable costs on profitability. Failing to include shipping, raw materials, or labor costs can result in incorrect break-even estimates.

2. Setting Unrealistic Selling Prices

Overpricing or underpricing products can skew break-even calculations. Ensure pricing aligns with market demand and competitor pricing.

3. Overlooking Market Demand

Reaching a break-even point is meaningless if there is no demand for the product. Businesses should validate customer interest before launching.

4. Not Considering Economic Changes

Inflation, supply chain disruptions, or economic downturns can impact both fixed and variable costs, altering the break-even point.

Real-World Applications of Break-Even Analysis

Break-even analysis is widely used across industries. Here’s how different businesses apply it:

1. Startups

Entrepreneurs use break-even calculations to determine whether their business idea is financially viable before launching.

2. Retail and E-Commerce

Retailers and online stores use break-even analysis to set optimal pricing strategies and manage inventory costs.

3. Manufacturing

Factories determine production costs and minimum order quantities using break-even analysis.

4. Service-Based Businesses

Consultants, freelancers, and agencies use break-even calculations to determine how many clients they need to serve to cover expenses.

5. Restaurants and Cafés

Food businesses calculate break-even points to balance costs of ingredients, rent, and staff salaries.

FAQs About Break-Even Analysis

1. What is a good break-even point?

A lower break-even point is generally better because it means the business can reach profitability faster and with less risk.

2. Can a company have multiple break-even points?

Yes! Businesses selling multiple products or services may have different break-even points for each.

3. How often should businesses calculate their break-even point?

Regularly—especially when costs, pricing, or business models change.

4. What happens if I don’t reach my break-even point?

Operating below the break-even point results in financial losses, requiring businesses to cut costs or boost sales.

5. Where can I find a reliable Break-Even Calculator?

Many financial websites offer free online break-even calculators for quick and accurate assessments.

Conclusion

A Break-Even Calculator is an essential tool for businesses to determine when they will become profitable. Whether you’re launching a startup, pricing a product, or analyzing business costs, understanding your break-even point helps you make smart financial decisions.

💡 Want to calculate your profitability? Try our free Break-Even Calculator today on Sharks Tank Pakistan! 🚀

Break-even Calculator

Results

Break-even Point: 0 units

By leveraging break-even analysis, businesses can confidently price their products, manage costs, and develop long-term financial strategies that drive success.