Shark Tank Pakistan startups are now under the Federal Board of Revenue (FBR) microscope for alleged money laundering. This decision underscores the critical role that regulatory compliance plays in the nascent startup ecosystem.

Making financial transactions clear and transparent for investors will help establish trust and lead to sustainable collaboration for the future. The resulting investigations bring to light the obstacles entrepreneurs are up against.

At the same time, they need to contend with the weight of complicated regulatory structures, all while promoting innovation and economic development in a highly competitive market.

Key Takeaways

- The investigation and prosecution of all business tax fraud is an aggressive priority of the Federal Board of Revenue (FBR) in Pakistan. They mainly focus on high-risk sectors, like the textiles and manufacturing sector, by using Directorate General of Intelligence & Investigation-Inland Revenue.

- Due to the program’s immense popularity, startups appearing on Shark Tank Pakistan receive enormous exposure. With this increased visibility comes greater scrutiny from regulatory bodies, making compliance with tax laws and financial reporting even more critical for these growing companies.

- Public attention from shows like Shark Tank can impact startups’ operational practices, making it essential for them to adhere to tax regulations to avoid legal challenges and sustain growth.

- Understatement of turnover and overstating of Input tax claim are common tax discrepancies harassing emerging startups. These issues can lead to significant fines, however working in advance with the FBR can protect you and your company from non-compliance.

- Legal and regulatory challenges can paint a dark legal cloud over promising startup growth and innovation. Such an environment will discourage investors and limit investment opportunities within the Pakistani startup ecosystem.

- Startups need to be particularly mindful of upholding their brand image and establishing public trust, even more so when under investigation. This strategy preserves consumer confidence and drives continued business expansion.

Understanding FBR Investigation

The Federal Board of Revenue (FBR) has issued a warning against any tax fraud. They enforce stringent measures, particularly through the Directorate General of Intelligence & Investigation-Inland Revenue. This third unit is on the front lines, examining financial records and identifying discrepancies that may point to online fraud.

Tight guidance means businesses in high-risk sectors, such as textiles and manufacturing, are subjected to unfair, disproportionate scrutiny. This is mostly because of their intricate supply chains and high volume cash transactions. These factors raise the likelihood of tax evasion, making them ripe for FBR audits.

The legal ramifications for engaging in fraud can be severe. Executives—especially CFOs—risk arrest and criminal prosecution, which can irreparably damage both individual and corporate reputations.

The FBR’s approach includes several key actions aimed at curbing these misrepresentations. Alarmingly, they have not publicly disclosed the initiation of these investigations. Startups involved struggle with compliance and face significant legal challenges.

- Filing of First Information Reports (FIRs)

- Detaining suspects

- Enhancing enforcement measures

Some startups have underreported their financial figures by as much as 80%, drawing massive attention for this alarming trend. Ahmed Rauf Essa, the Chief Executive Officer of Telemart, recently highlighted this predicament in a LinkedIn post.

He anticipated this criticism due to the high profile of Shark Tank Pakistan. This situation underscores the immense challenges that remain in Pakistan’s startup ecosystem, affecting innovative founders and their ventures.

The need for transparency and adherence to legal obligations is essential for fostering a healthy entrepreneurial landscape in the country.

Shark Tank Pakistan Startups

Shark Tank Pakistan has proven to be a revolutionary platform, taking the young but ambitious startups to the spotlight and providing them with priceless exposure. This broad visibility helps to attract the right investors, particularly in the realm of Pakistani startup investment. However, it has raised the ire of regulatory authorities like the Federal Board of Revenue (FBR).

The very startups that had previously found success through their creativity now struggle to meet compliance demands with tax laws and financial reporting. Some companies reported only a fraction of their actual financial figures, according to media reports. This situation is particularly perplexing given the serious concerns about widespread online fraud and non-compliance.

Public scrutiny was able to shift a startup’s processes in a major way, exemplified by a recent investigation into their tax discrepancies. The attention triggered a fierce discussion on whether Pakistan’s tax regime is suitable for the fast developing startups. While some view these investigations as necessary for accountability, others argue that the system needs adaptation to better support new businesses.

The show continues to face those challenges directly. It serves as an incredible educational experience too, featuring local brand innovators who share insights on building and scaling companies. Its production quality and educational approach, despite a distinct lack of panel diversity, have received praise.

Presented by Pakistan’s leading corporate sponsors, the program transcends a mere television show to drive a lasting positive impact on the entrepreneurial ecosystem, fostering growth for innovative founders and attracting global venture investment.

Tax Discrepancies in Startups

Avoiding a significant tax liability can be especially difficult for startups. They are frequently subjected to issues like turnover misreporting and false claims on input tax. These discrepancies may be the result of misunderstanding or inattention.

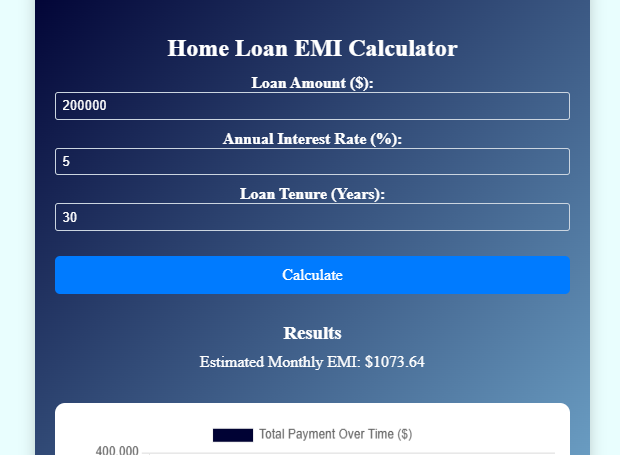

Most startups only report 15-20% of their financials to the FBR. This practice deserves the microscope it has been under. Most recently, the FBR initiated tax investigations against startups featured on Shark Tank Pakistan.

Ahmed Rauf Essa, the CEO of Telemart, said that these companies were raised on discrepancies. This new scrutiny makes it all the more critical to tackle these issues head-on and from the outset.

To align with FBR regulations, startups should engage in open dialogue with the authority, ensuring their financial reporting is clear and accurate. Fraudulent practices, like submitting invoices with fictitious vendors or misreporting financial information, lead to fines, but create negative perceptions.

It’s important to make sure you take these lapses on directly to stay compliant. Startups can benefit from:

- Keeping accurate and complete financial records

- Regularly updating financial statements

- Seeking professional financial management

- Adhering strictly to tax regulations

Though industry leaders recommend that startups eat the compliance burden, others are calling for the IRS to implement more startup-friendly tax policies. These are all good measures that could create a more welcoming environment for entrepreneurship.

Implications for Startup Growth

For Pakistan’s burgeoning startup ecosystem, the fear of legal repercussions from FBR investigations can threaten the opportunity for exceptional growth. This level of scrutiny creates a chilling effect, slowing innovation and entrepreneurship, particularly in the tech sector. When legitimate startups are drawn into the web of regulatory investigation, the chilling effect is felt throughout the ecosystem, dissuading the next great idea from ever coming to market.

This is especially true in Pakistan, which today finds itself in the midst of its first wave of app economy startups. The opportunity is huge, particularly in fintech, where banks have long restricted access to consumer lending. However, the prospect of regulatory barriers can freeze this growth in its tracks, impacting several startups.

The effect of regulatory challenges on startups goes beyond hurting their operations. They scare away potential investment. The chilling effect of legal ambiguity can lead investors to be skittish, cutting off opportunities for much-needed funding, especially for innovative founders.

Despite its immense entrepreneurial talent and smartphone adoption, Pakistan has so far brought in only a tiny fraction of the startup investment. This lack of meaningful investment stops businesses from growing and innovating, particularly in sectors such as consumer products, including organic and local foods, that are just beginning to take off.

With investigations underway, protecting a positive brand image has never been more important for entrepreneurs aiming to attract venture investment.

Startup Implications

It can be a challenge for consumer-facing startups to maintain consumer confidence, as public trust can be tenuous in crisis times. It’s hard to know, because the vast majority of startups release fewer than 20% of their financial statistics.

In comparison, organizations such as Shark Tank Pakistan provide 100% transparency, revealing a huge chasm. By emphasizing sound financial management and tax compliance, a startup can avoid these issues and maintain its hard-won reputation.

Below is a table illustrating the potential trade-offs between aggressive growth strategies and the need for compliance with tax regulations:

| Aggressive Growth Strategies | Compliance with Tax Regulations |

|---|---|

| Rapid expansion and market capture | Ensures long-term sustainability |

| Increased risk of legal scrutiny | Reduces risk of regulatory issues |

| Attracts quick investor interest | Builds investor confidence through trust |

| Potential for short-term gains | Establishes a solid foundation for growth |

Conclusion

Shark Tank Pakistan startups are currently under the spotlight with FBR investigates startups. This makes for a very difficult landscape for entrepreneurs. It’s not merely navigating complex tax laws that is important, it is trust that is key. Not only do startups have their own set of challenges, but compliance is key to fostering growth. Pakistan’s entrepreneurs are resilient and step up to meet these challenges.

So knowing the gaps between taxes owed and tax paid is key to their success. This new reality presents a unique opportunity for learning and growth. By prioritizing transparency and compliance from the start, startups can establish firm ground rules. Holding people accountable to do the right thing builds a culture of honesty and trust.

It creates opportunity for long-term growth. The lesson for entrepreneurs is this — know the landscape and be prepared to act. Collaborate closely with your experts and peers. Provide ideas and help foster the development of the nascent startup community. We hope you will be part of this ongoing dialogue and help us continue to make real change happen.

Frequently Asked Questions

What does FBR investigation involve?

FBR investigations are primarily aimed at ensuring tax compliance, particularly for federal startups and their financial figures. Often, these investigations are initiated by misrepresentations or even evasion, highlighting the importance of accurate sales pitches.

Why are Shark Tank Pakistan startups under scrutiny?

Some of the local startups, including several innovative founders featured on Shark Tank Pakistan, are currently under investigation for tax discrepancies. These inquiries aim to ensure compliance with tax law and proper reporting of taxable income for Pakistani startups.

How do tax discrepancies affect startups?

Tax differences can lead to penalties and criminal prosecution, severely harming a startup’s reputation and undermining investor confidence in the entrepreneurial ecosystem.

What is the impact of FBR investigations on startup growth?

FBR investigations can impede growth, consuming time and energy that should be dedicated to business development rather than legal challenges. This can scare away potential investors, particularly in the context of startup investment, due to perceived risks.

How can startups ensure compliance with tax regulations?

Startups should always maintain clear financial records and frequently consult with tax professionals to navigate legal challenges. This awareness of changing tax laws helps prevent misrepresentations and ensures compliance.

Are all Shark Tank Pakistan startups under investigation?

It’s important to note that not all startups, particularly those in the entrepreneurial landscape, are under investigation; only those with known or suspected tax discrepancies are scrutinized by the FBR.

How can startups recover from an FBR investigation?

Startups need to clear up such discrepancies right away and set the tone for better financial practices going forward, especially in the context of venture investment. Transparent communication with all affected stakeholders is part of the solution in rebuilding trust.